How to break the cycle of late payments

Payments are at the heart of any accounting and bookkeeping firm. But what happens when your clients don’t pay on time? The cost isn’t just financial. There’s often an emotional toll, a drain on time, and a real barrier to growth.

We surveyed 800 small-to-medium business (SMB) decision-makers across Australia and New Zealand to better understand the state of late payments today, and the findings are powerful.

The GoCardless Pursuing Payments 2025 report uncovers the true impact of late payments and what you can do to break the cycle.

1. The pursuit of payments is still a time drain for many businesses

Over a quarter of small businesses report spending up to an hour every single week just chasing down late payments.

Think about that – a full hour of every work week, gone. That’s an hour that could be spent onboarding new clients, innovating, or simply focusing on what you do best. Instead, it’s lost to the frustrating and awkward task of debt collection.

Unfortunately, the problem isn’t getting any better. Nearly half of SMBs are waiting longer for payments now than they were just 12 months ago (48% in Australia and 51% in New Zealand). And with rising living costs, it’s no surprise that 59% are worried this trend will only get worse.

2. Late payments take a financial and emotional toll

While the time sink is bad enough, the financial and emotional impact can be far-reaching.

41% of Australian SMBs and 35% of New Zealand SMBs report that their payments are, on average, more than 14 days overdue. And these delayed payments inflict a substantial financial hit with 15% of SMBs in both countries losing up to $1,000 every month.

Our research also showed the heavy emotional cost. Chasing money creates tension with customers, causes stress, and makes business owners feel anxious and frustrated. It’s a vicious cycle that can distract from your day-to-day business and core purpose.

3. Bad cash flow is bad for growth

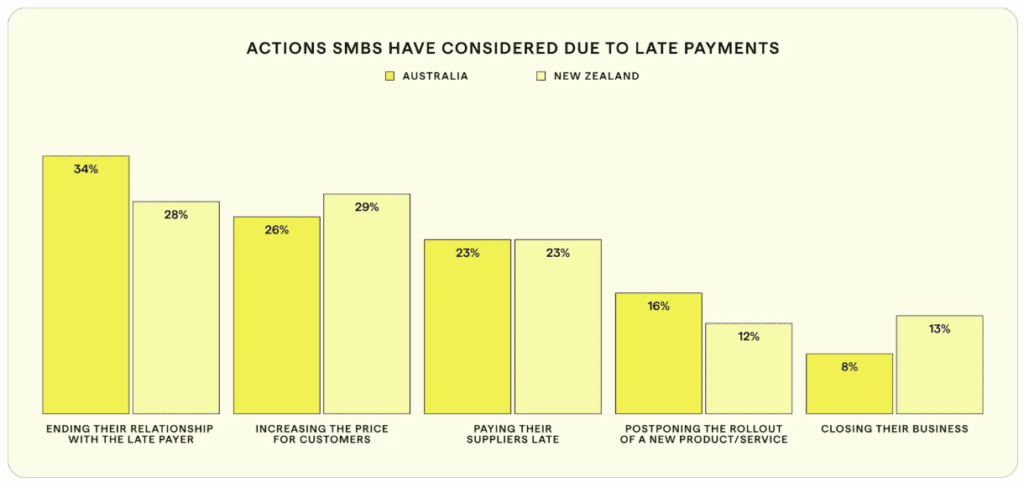

Delayed payments often mean poor cash flow and can result in businesses having to put a hold on future plans. Here are a few growth-stunting actions Australia and New Zealand SMBs have been forced to take due to late payments:

- Ending their relationship with the late payer

- Increasing the price for their customers

- Being late paying their suppliers

- Postponing the rollout of a new product or service

- Closing their business

4. Late payments don’t have to be inevitable

So, what’s the solution? The good news is that SMBs are hungry for change. Two-thirds of the businesses we surveyed said they’re interested in using new technology to get a handle on late payments.

That’s where technology comes in. By adopting modern methods like bank payments with GoCardless (think, payments that are made from one bank account directly to another, including BECS Direct Debit and PayTo) you can create, schedule and collect payments for your client invoices on their due date – all from your existing Xero setup.

It’s time to put a stop to the endless admin, reduce costly payment failures, and get paid up to 47% faster. Connect GoCardless to Xero to automate invoice payments, and take back control of your business’s cash flow and growth.