Get your bills under control with Online Bill Payments

Last updated: Feb 19, 2026

Paying bills shouldn’t mean juggling multiple logins, spreadsheets and bank visits. Yet for many small businesses, bills, payments and accounting live in different places, making cash flow harder to track. Nearly half of invoices are paid late, 44% have been caught short by unexpected expenses, and more than a third struggle to cover what’s due — so 29% of owners check cash flow daily just to stay on top.

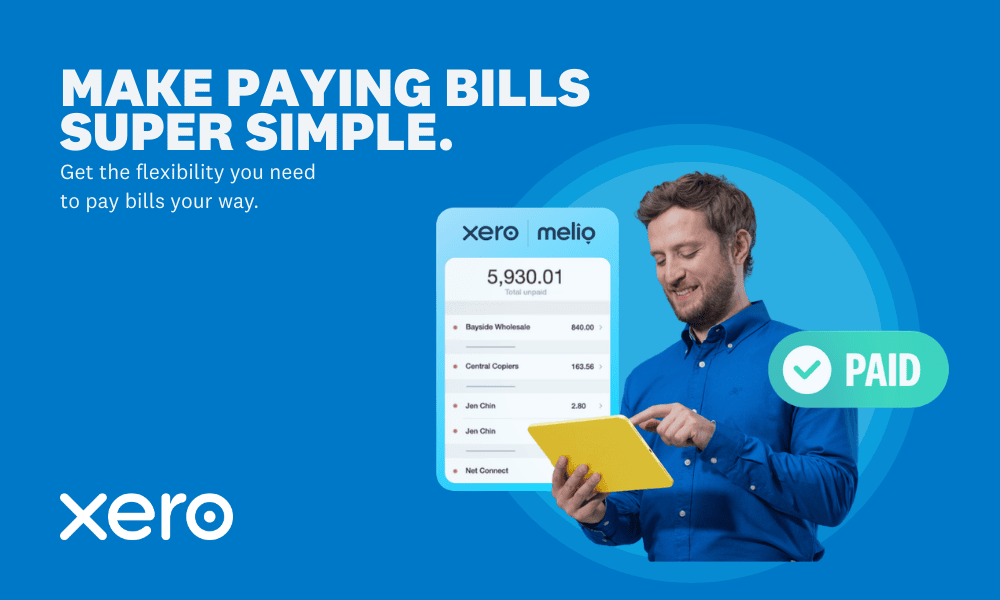

Online bill payments combines the power of Xero’s supercharged platform and Melio’s payment processing capabilities, giving you more control, fewer tools to manage and a clearer view of what’s going out the door — all without leaving your accounting platform. It’s designed to help small businesses turn bill payments from a constant headache into a more predictable, manageable part of running the business.

Everything in one place

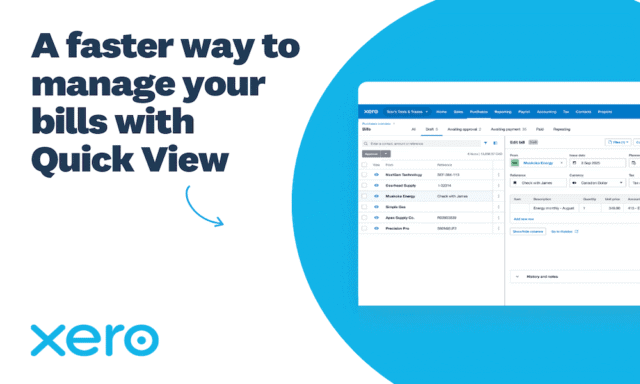

Over half of US small businesses spend more than four hours every month managing accounts payable — and many say not being able to manage and pay bills all in one place is a major source of frustration. By embedding bill payments directly into the Xero experience, the all-in-one platform removes the need for separate banking portals or third-party tools, allowing small businesses to manage bills, approvals, payments and reconciliation in a single workflow.

With online bill payments, U.S. small businesses can:

- Make paying bills simple by managing everything directly from Xero

- Save time every month as bills are automatically marked as paid and reconciled by JAX

- Pay bills their way by funding payments from a bank account or credit card, paying one or many bills at once, and scheduling or expediting payments to better align with cash flow

- Always know where they stand with real-time visibility into what’s due, what’s been paid and overall spending

Across Xero customers, small businesses using Xero say they save around five hours a week on bill management when bill management, payments and reconciliation are handled together in Xero rather than across multiple tools. That’s time you can give back to higher‑value work — or simply take back from after‑hours admin.

“So far I love it! It’s easy to use, efficient and effective. And for about the cost of a stamp! I’ve used it to pay individuals and businesses. I consider it a great value-add to my Xero membership”. Alexei Rudolf, Foodservice Connections LLC

More cash flow control

Cash flow is the lifeblood of any small business, and persistent pressure on it is one of the biggest reasons businesses fail in the US. When you can see all your upcoming bills alongside the money coming in, it becomes much easier to decide what to pay and when — instead of constantly worrying about whether there’ll be enough in the account when payments hit.

With Xero’s dashboard, you can already see what you owe and when it’s due. Online bill payments helps to keep you in control of your cash flow by scheduling payments, using your preferred method of payment – all while keeping your suppliers happy with on-time payments.

Being able to plan and execute payments from the same place you manage your books helps turn cash‑flow uncertainty into more cash‑flow clarity.

Built for advisors and their clients

Online bill payments also supports modern, flexible accounts payable workflows for advisors and their clients.

With bills, payments and reconciliation in one place, advisors can:

- Help clients manage bills, process payments and reconcile transactions directly in Xero, reducing manual work and errors across the workflow

- Get clients started in less than five minutes from within Xero — there’s no separate Melio subscription required, and bill payments is available on all US Xero business plans

- Maintain accurate, up‑to‑date records without needing direct access to client bank accounts, because payment status and reconciliation live in Xero

Approval workflows and the ability to delegate payments requests will also be launching in 2026.

For firms, that means fewer one‑off workarounds to move money or clean up mismatched records, and more time to focus on higher‑value advisory services instead of routine accounts payable tasks.

Back in the driver’s seat

When bills are organized, payment workflows live in one place, and your accounting reflects what’s really happening in your bank accounts, it’s easier to step back from day‑to‑day admin and focus on running and growing your business.

By combining Xero’s accounting and cash flow insights with online bill payments powered by Melio, you get:

- One place to see what you owe and when it’s due

- One place to decide how and when you’ll pay

- One set of books that reflects reality, with less manual clean‑up

Now you can stop asking “Can I cover what’s due this week?” to make more confident calls about building your business.

Online bill payments is now available on all U.S. Xero business plans, with no extra subscription or per-user fees. You’ll only pay transaction fees when you choose to make online payments in Xero. It’s another step forward in Xero’s mission to supercharge your business so you spend less time on admin and more time focusing on what matters.

Want to learn more? Visit https://www.xero.com/us/accounting-software/online-bill-payments/ for details on how to get started.