How to manage the Singapore GST rate change in Xero

Last updated: Oct 25, 2025

Last updated: 20 December 2022

In the 2022 budget announcement, Singapore’s Minister for Finance announced the GST rate will increase from 7% to 8% on 1 January 2023, and from 8% to 9% on 1 January 2024. This change will impact all Singapore businesses that file GST. Here’s what we’re doing to make it easy for you to manage this change in Xero.

Update your default rate

We’ll make the new 8% rate available in Xero by 9 December 2022. The former 7% rate will have ‘2022’ noted so you can easily tell the difference.

There are a number of areas where you can set default tax rates in Xero. This includes your contacts, your inventory items, and accounts in your Chart of Accounts. Any transactions using those contacts, inventory items or accounts will continue to default to 7% unless you update them.

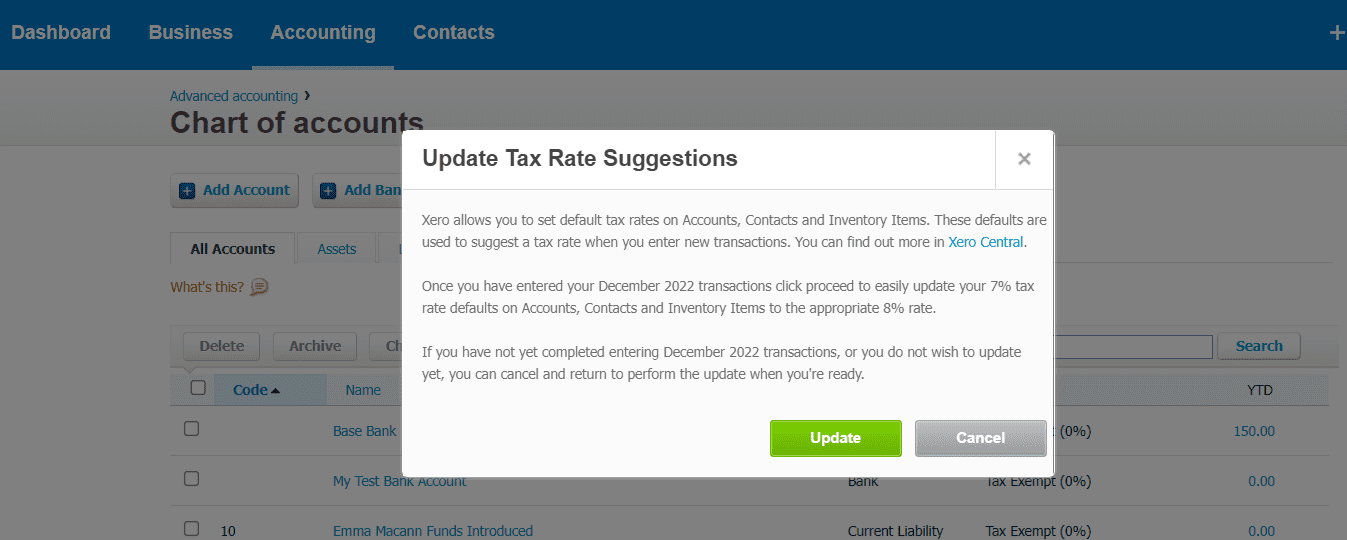

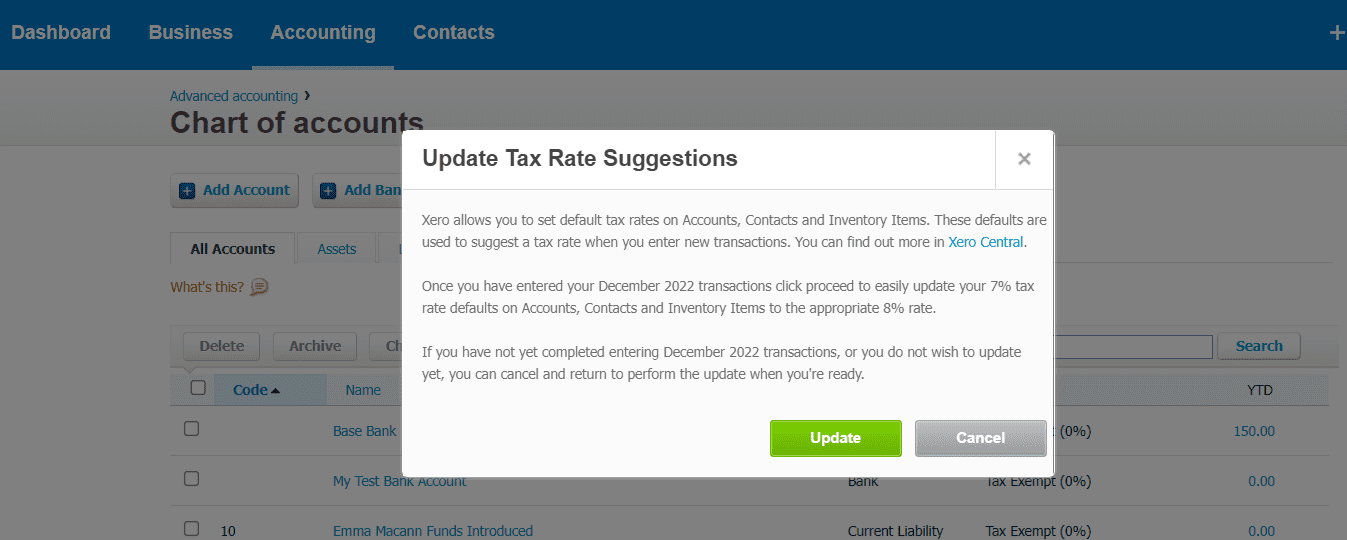

To help you do this, on 2 January 2023 we’ll be introducing a new button at the top of your Chart of Accounts page, called ‘Update to 8% defaults’. You will only see this button if you have a Standard or Advisor role and you have applied a Xero default tax rate (not a custom rate that you’ve created) to any of your contacts, inventory items or accounts in your Chart of Accounts.

The button will help you update the GST rate on your contacts, inventory items and accounts. All you need to do is select ‘Update’ on the pop-up to complete the process. If you have more than one Xero organisation, you’ll need to do this for each one.

If you haven’t completed this by 1 February 2023, Xero will automatically update your Chart of Accounts with the new rate for you. If you also had default tax rates set up for your contacts and inventory items, then Xero will update these for you too.

Start using the new rate

From 1 January 2023 (when the GST rate change occurs), you’ll need to make sure that you’re using the correct GST rate when using Xero. Here are some places where the old rate may still appear and need to be updated by you:

- invoices and bills

- bank reconciliation

- automated bank rules

- repeating invoice templates (especially those set to ‘Approve to send’) and repeating bill templates

- draft transactions dated from 1 January 2023 (including invoices, bills and manual journals)

- apps you may have connected from the Xero App Store or another provider

- if you use Hubdoc, you will need to update the default tax rate, which will apply to any new suppliers moving forward. For existing suppliers, you will need to update the tax rate information on a supplier level

If you’re a Xero advisor, you’ll also need to check:

- Xero HQ Chart of Account templates (from 2 January 2023, you can use ‘Company – 2023 – 8% GST Rates’ for the new rate, or ‘Company – 2022 and earlier – 7% GST rates’ for the old rate)

- financial practice settings in Xero Practice Manager

We’re here to support you

We’ll let you know when the new tax rates are available in Xero, and remind you to update your default rates when the new rate comes into effect on 1 January 2023. You can also join us for one of our live webinars run by our Singapore tax specialists, to help you make the transition.

In addition to the GST rate change, there will also be some changes to tax rates of imported low-value goods and remote services that will apply from 1 January 2023. We’ll have new tax codes to account for these transactions in Xero, so you can start using the new rates straight away.

GST returns and direct filing to IRAS are available in all Xero business edition plans, starting at $35 SGD per month. If you’re not a Xero customer, sign up for a free trial to discover how you can use Xero to help manage your accounting needs.

If you have any questions about our business edition plans, or need a hand managing these upcoming changes in Xero, please reach out to our team for support. We’re always here to help.

Please note that this information is general in nature and does not constitute advice. You should consult your own professional advisors for advice directly relevant to your business.