Latest product news — October 2022

Last updated: Oct 18, 2025

We’ve released a number of new features over the past month, with a focus on helping you manage your compliance needs. This includes new earnings categories in Xero Payroll to support Single Touch Payroll (STP) Phase 2 in Australia, as well as the launch of document packs in the UK to help advisors easily collate documents and get them electronically signed by clients.

If you’re a Xero partner, don’t forget to register for our upcoming quarterly product update, where our education team will walk you through a demo of all the latest releases, so you can maintain your advisor certification.

New features

Bring saved layouts across to new reports — Global

We’ve made a number of enhancements to new reports in Xero over the past month. Don’t forget, we’re retiring the older versions of our reports in Xero, so you’ll need to start moving your work across to the new versions. You won’t be able to use the older versions of our reports from 31 July 2023.

- We’ve introduced a new tool to help you bring saved layouts (row settings only) in Profit and Loss and Balance Sheet reports across to the new versions. Simply click on the link in the banner at the top of the report, or use the tips and tricks panel. This tool is not available for read-only or cashbook users.

- We’ve added a new feature to the layout editor, so you can set up grouping rules based on account codes. This means any new account that fits the rules criteria will be automatically shown in the right section of the report. This feature is available in all reports with access to the layout editor.

- After a successful pilot adding a chart in the Expenses by Contact report, we’ve now added this chart to the Income by Contact report for all customers globally.

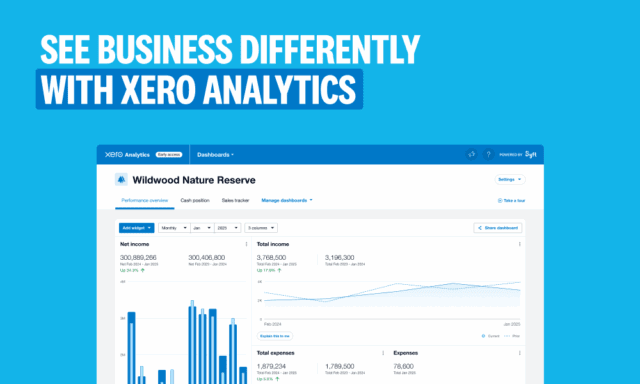

Better track your performance in Xero Analytics — Global

We’ve made a number of updates to Xero Analytics and Xero Analytics Plus, which help you analyse trends and get a deeper understanding of how your business is performing.

- In Australia, you will soon be able to see your BAS and PAYG within short-term cash flow in Xero Analytics Plus, and drill down from there into the activity statement

- We’ve refreshed the look of the profitability section in business snapshot, to better align the tiles and improve accessibility

- We’ve added new gross profit margin and net profit margin tiles to the business snapshot dashboard, and updated some wording to be consistent with other tiles

Manage POs and contacts in the Xero Accounting app — Global

You can now create new purchase orders and edit existing purchase orders in the Xero Accounting app. This feature is new to iOS and was already available for Android users. It will help you manage the purchase process on the go, rather than waiting until you’re back in the office.

We’ve also updated the contact list in the Xero Accounting app, so you can easily filter and sort between customers and suppliers. This will help you find relevant contacts quickly, so you can complete tasks and stay on top of your relationships.

Understand your document packs usage — Global

The new document packs chart in Xero HQ helps you understand your monthly transaction usage over the past 12 months, so you can work out which Xero Sign bundle best suits the needs of your accounting or bookkeeping practice at any time.

See how we’re ‘Building on Beautiful’ — Global

As part of our commitment to ‘Building on Beautiful’ — which is about continuously upgrading our technology to build new features faster, giving our platform a consistent look and feel, and making sure we keep accessibility top of mind — we’re making some changes in Xero:

- Last year, we updated the ‘import’ page in bills. Next on our list is ‘Bills to pay’. There are a number of changes you can expect to see on this page in the months ahead, including a new design, updated filters, a compact view toggle, and more.

- You’ll notice improvements to the quotes table in the weeks ahead, including the ability to customise columns displayed, apply whole number discounts, see stock on hand, tab through the table quickly, and more.

Filter transactions in Xero Projects – Global

As a result of customer feedback, we’ve made improvements to the Projects Summary report in Xero Projects, which gives you a basic summary of your project financials. In the weeks ahead, you’ll be able to filter transactions by accrual date, and use the new uninvoiced amount column to help you stay on top of your project cash flow.

Use new earnings categories in Xero Payroll — Australia

As part of Single Touch Payroll (STP) Phase 2, you will need to report gross figures for each income type as separate, itemised amounts. We’ve updated the earnings categories in Xero Payroll to support STP Phase 2 and created a handy pay item transition tool to help you complete this task.

Map your sales tax rates in Xero — Canada

Since expanding our coverage to support all federal and provincial sales tax return reports, we’ve been focused on improving your experience to make the process easier and more efficient. As part of this, we’ve made the following updates in our sales tax reports:

- added banners and notifications that let you know when there are tax rates which need to be mapped in your return, with links to those rates

- made changes to the audit report, so transactions associated with unmapped tax rates are grouped for easy identification

- changed the tax rates page so tax rates that need attention are grouped separately, with any exports noting if there were tax rates needing attention at the time of export

View US dates in new invoicing — US

We know it’s confusing when your dates are displayed as DD/MM/YYYY instead of MM/DD/YYYY. That’s why we’ve updated the ‘edit’ and ‘view’ pages in new invoicing to reflect the standard US date format. This includes ‘convenience dates’ in both the invoice and due date dropdown menus.

Enjoy Xero bank feeds with Allied Irish Bank — UK

Since Brexit, our Financial Conduct Authority licence in the UK could no longer be ‘passported’ to other EU countries, and we were forced to turn off our bank feeds in Ireland. We have recently been approved as an Account Information Services Provider in the EU and as such, have resumed bank feeds for Irish customers — starting with Allied Irish Bank. Our feed for Bank of Ireland will follow soon.

Collate, send and sign documents in Xero — UK

Document packs will go live in the UK on 4 October 2022. This secure e-signing solution allows clients to easily view, download, electronically sign and return documents to their accountant or bookkeeper — all within Xero. It integrates seamlessly with Xero Tax, which means you can share accounts and tax returns for companies and individuals directly with your clients for review and signature.

Securely store Government gateway IDs for personal tax — UK

When using Xero Tax for personal tax, advisors can now easily store and use government gateway ID information. This means practice staff no longer have to manually key in the information every time when submitting tax returns, or share gateway passwords among the team. You can now securely store multiple gateway IDs and maintain these records, as well as easily toggle between details when submitting a tax return.