Latest product news — November 2022

Last updated: Oct 18, 2025

Over the past month, we’ve made updates to support the transition to Single Touch Payroll Phase 2 in Australia, improvements to eInvoicing, changes to multi-factor authentication, and more. Read on for more details about these and other product updates in Xero.

New features

Enjoy more beautiful reports — Global

We’ve made a number of enhancements to new reports in Xero over the past month. Don’t forget, we’re retiring the older versions of our reports in Xero, so you’ll need to start moving your work across to the new versions. You won’t be able to use the older versions of our reports from 31 July 2023.

- We’ve introduced bar charts to the Top Customers and Top Vendors reports. You can also switch between a bar chart, treemap chart or donut chart in the Expenses by Contact and Income by Contact reports.

- The presentation of tracking columns has been improved in new reports where ‘follow report date’ range is used. When the date of the column matches the date of the report, we now only display the tracking option name, and don’t also repeat the report date in every column heading.

Search and view tax rates in new invoicing — Global

US and Canadian customers can now search and view the numeric tax rate in new invoicing, rather than just the tax rate name. This will give you confidence that the tax rate you’ve chosen for each line item is correct. The rate is shown in brackets next to the name in the line item dropdown and when searching in the cell.

See how we’re ‘Building on Beautiful’ — Global

We’re making some changes in Xero as part of our commitment to ‘Building on Beautiful’ — which is about continuously upgrading our technology to build new features faster, giving our platform a consistent look and feel, and making sure we keep accessibility top of mind.

- We’re updating the look and feel of the dashboard in the Xero Accounting app (iOS), making it easier for you to view and find information about your business.

- You can now create an inventory item on the fly in Xero, instead of being redirected to the products and services page. When an inventory item has a file attached, you can now preview the file from the inventory list view, making it easier to preview files.

- We’re making some updates that will give you a better experience when entering employee information into Xero Payroll (Australia). This includes a new design, address auto-fill and the ability to invite employees to Xero Me from within the employee record.

- We’re making improvements to the design and functionality of the list page in quotes. These updates include more bulk actions, coloured status tabs and improved search and filter functionality.

- We’re making some changes to the look and feel of the assurance dashboard, to make it more consistent with History and Notes and other pages across Xero.

Re-authenticate your device every 24 hours — Australia

If you access an Australian organisation, you’ll now need to re-authenticate your device every 24 hours when logging in to Xero. This is a result of regulation changes by the Australian Taxation Office. You can still use your preferred authentication method, such as Xero Verify, Google Authenticator or Authy apps.

Transition your leave balance to STP Phase 2 — Australia

We’re now arriving at the final stage of Xero’s transition to Single Touch Payroll (STP) Phase 2, which introduces a set of new ATO reporting categories for paid leave. You will now need to categorise any existing paid leave types as either Other paid leave (Type O) or Ancillary and defence leave (Type A). You can easily do this with our transition tool available in Xero Payroll.

Apply credit notes to an eInvoice — Australia & NZ

Previously, a negative eInvoice could not be approved in Xero. We’ve made an update so that negative eInvoices can now be converted from a draft bill into a credit note, making it easier to approve in a few clicks.

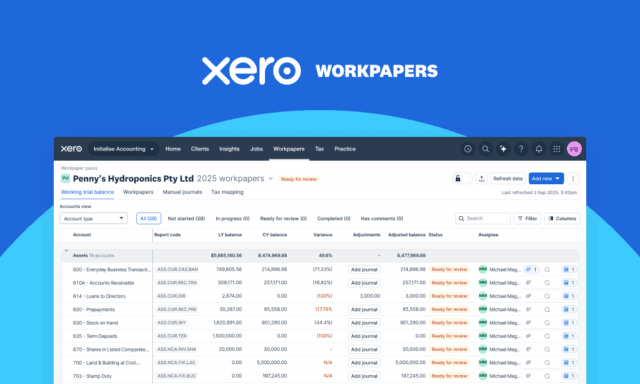

Try the Working Trial Balance beta in Xero Workpapers — Canada

Our new Canadian beta allows you to easily generate a read-only view of the Working Trial Balance within Xero Workpapers. You can also validate the effect of postings immediately on the adjusted trial balance, and identify any potential errors when reviewing year-end journals.

File your GST F5 forms in Xero — Singapore

You can now submit your GST F5 returns directly from Xero to IRAS in one click, eliminating the need to log into myTax portal to input tax figures manually. Once submitted, you will receive a notification of your GST F5 return status from IRAS. You can use the acknowledgment number in that notification to view the details of your return in the IRAS myTax portal for three working days.

Maintain compliance with National Insurance rates — UK

The UK Government recently announced a reversal of the 1.25% percentage point contribution to National Insurance. This change comes into effect from 6 November 2022. We’ve made the required rate updates within Xero Payroll that will automatically be applied to pay runs processed from this date onwards. If you have already posted or drafted a pay run to be paid after this date, we may ask you to take action before then, so the correct calculations are applied.

Change the way you connect to NEST — UK

We’ve made the connection between Xero Payroll and the NEST workplace pension scheme faster and even more secure. Now, when you connect your Xero account to NEST for the first time, you’ll need to provide your NEST credentials, which includes your employer ID, username and password.