Latest product news — June 2022

Last updated: Nov 22, 2023

We’ve made a number of enhancements to the Xero platform in the last month, including updates to quotes, reporting, Xero Analytics Plus, WorkflowMax and more.

New features

Send files as email attachments with quotes — Global

In the weeks ahead, we’re rolling out a new feature that will allow you to send files as email attachments with your quotes. This means your customers can open attachments (such as terms and conditions or a sales brochure) from the email itself, rather than a webpage. This is a long-standing community request that will help you send everything you need in one seamless communication.

Add folders to your invoices in WorkflowMax — Global

We’ve released new functionality that lets you send an invoice in WorkflowMax, based on the folders you’ve created. This means you can transfer information from your folders directly into the invoice for the job or project. The details will also integrate into Xero, if you use it. This feature has been requested by many customers, and will be a real time saver for businesses invoicing out of WorkflowMax.

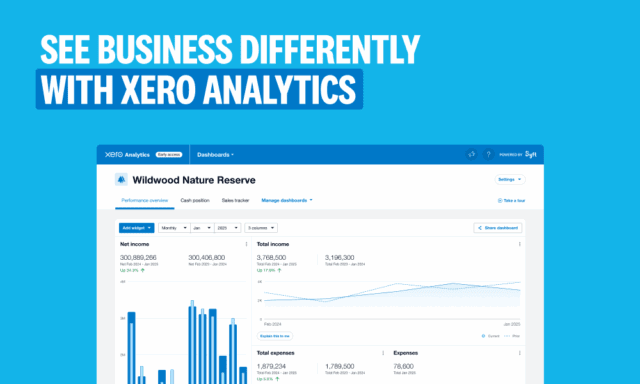

Tailor your business snapshot in Xero Analytics Plus — Global

If you use Xero Analytics Plus, you’ll know that last year we introduced a feature that allows you to customise how your expenses are displayed, via the ‘Edit metrics’ side panel. We’ve now enhanced this feature, so you can control which metrics are displayed in your business snapshot dashboard.

Simply visit the ‘Edit metrics’ side panel and select ‘Hide or show metrics’, then uncheck the boxes you don’t want to see on your dashboard. We’ve also added the ability to drill-down to a transaction level into the free version of Xero Analytics.

Get quick access to answers in new reports — Global

You can now customise your comparison periods in new reports. Depending on the date range of the report, you can compare two identical date ranges of your choice instead of making these adjustments manually in ‘Edit layout’. For example, you may like to compare last month with the same month in a previous year.

We’ve also built a simplified version of the Receivable and Payable Invoice reports, to help you identify who your top customers and suppliers are in a single click. These common formats are available from the side panel in these reports, as well as the overflow menu in the report centre. The default is set to last quarter, but you can use the date picker to change the reporting period to a range that suits you.

See your cash balance in the Xero Accounting app — Global

We’re updating the home screen of the Xero Accounting app, so you can understand your overall cash balance position. You’ll be able to customise which accounts are displayed, to help you make informed decisions on the go. This release is being rolled out in a phased approach to all Xero Accounting app users globally in the months ahead.

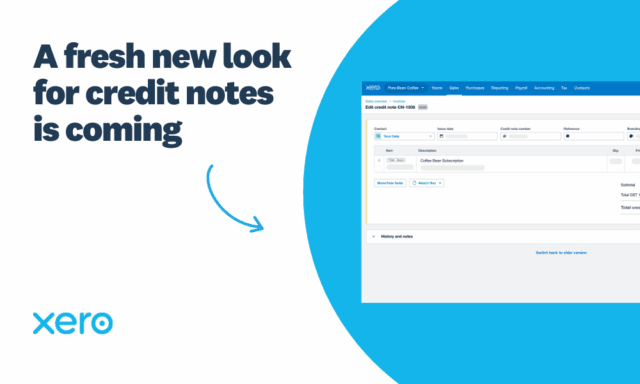

Reimagine your Xero experience — Global

We’re continuing to roll out our fresh new look across Xero. It’s all part of our work to upgrade the technology that underpins the Xero platform, so it doesn’t slow us down over time. This upgrade will help us deliver the features you need in your business or practice, while also improving speed and accessibility. Here are the most recent design changes in Xero:

- An upgraded experience in quotes, with a fresh design and some changes to the way you add a new inventory item, add an account, add or edit a currency, and attach a file.

- A new design in the Xero Accounting app dashboard (Android) and bank reconciliation screen (iOS and Android). This release is being rolled out in a phased approach in the weeks ahead.

- The introduction of a compact view in new reports, to reduce the vertical white space between rows of financial data.

- A new look for the employee list page in Xero Payroll (Australia).

Cash out paid leave and leave loading in Xero Payroll — Australia

We’ve made cashing out paid leave and leave loading easier, so you can start reporting it separately as part of the STP Phase 2 rollout. Payroll admins can now do this the same way you add a regular leave request in Xero Payroll (not available via XeroMe or MyPayroll). We will automatically calculate Schedule 5 or PAYG tax and display the leave loading on the employees’ payslip.

Map incomplete tax rates in Xero — Canada

If you have unmapped tax rates in Xero, the incomplete tax rates will now be grouped at the top of the tax rates page. From there, you can easily add the missing tax type and location on the tax return where they should be mapped. Once you’ve mapped your tax rates in Xero, you won’t need to do it again. We’ll be highlighting incomplete tax rates on the sales tax report in the months ahead, which will take you directly to the tax rates page to complete this task.

Easy e-signing with document packs — New Zealand

Collecting signatures from clients on financial statements, tax returns and other documents is a vital job for an accountant or bookkeeper. We’ve launched document packs to help you collate documents in packs, add tax returns from Xero Tax, share them securely and get clients to e-sign them, all within Xero. Xero Sign powered by Adobe Acrobat Sign is free for all New Zealand Xero Partners until 30 November 2022.

Stay compliant when calculating GST — Singapore

To help you remain compliant when calculating GST, we’ve introduced new transactional boxes in the GST F5 return and automated all boxes so the latest tax rates are applied. New tax rates have also been established to accommodate tourist refunds, bad debt, overseas vendor registration and IGDS.