Latest product news — February 2023

Last updated: Nov 22, 2023

It’s time to switch to new reports

If you haven’t made the switch to new reports, we urge you to start moving your work across now, so you have plenty of time to get used to them before the older versions are retired. Here are the latest features we’ve introduced to new reports:

- The current column in Aged reports is now automatically hidden when it’s not needed (such as when ageing by invoice date) or if it’s empty

- You can now run aged reports at the end of the current month by default, instead of ‘as at’ today’s date

- We’ve changed the Aged reports so that invoices which fall on the report’s date are now included in the first ageing bracket, instead of the Current column

- There is an additional option in the ageing periods dropdown menu in aged reports, that lets you return the report to how it was before the change

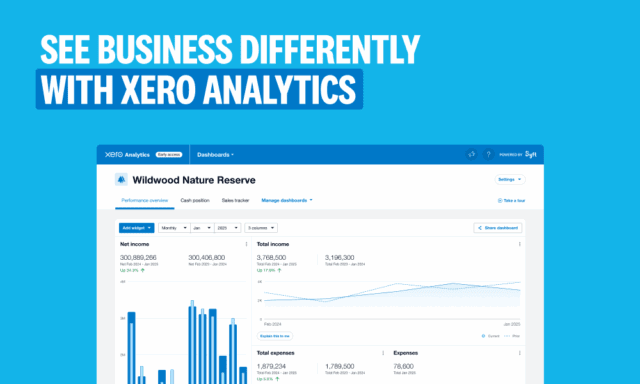

- A new tag that hovers over the graph in short-term cash flow within Xero Analytics Plus lets you see when your Business Activity Statements and Pay As You Go Withholding amounts are due (Australia only)

- Global settings has been released in the US, allowing you to set preferences for specific organisations such as the default accounting basis, decimals, account codes and more

See how we’re Building on Beautiful

We’re making some changes in Xero as part of our commitment to Building on Beautiful — which is about continuously upgrading our technology to build new features faster, giving our platform a consistent look and feel, and making sure we keep accessibility top of mind.

- We’re making improvements to the ‘Bank search’ page to make it easier for you to find your financial institution when you’re setting up a bank feed

- We’ve made improvements to the ‘Add bank account’ page, to make it easier for you to add a bank account

- Xero now offers an easier way to import bank statements, as well as more flexibility when bringing transactions into Xero

- The employee details page in Xero Payroll will be updated with a new design and feature a new autocomplete tool for the address field, to reduce the risk of errors

- A new link to payroll settings has been added to the payroll dropdown menu in Xero

- We’re making improvements in the way information is displayed on the dashboard within the Xero Accounting App, allowing you to reorder widgets in a way that suits you

- The CIS Contractor report has been upgraded with a new design, and now includes a PDF preview of Payment & Deduction statements

Other new features in Xero

Improvements to Xero Projects

- The Detailed Time report has been updated with new date filtering, so financial figures are based on the accrual date rather than the date when the report is published

- Start and end times for time entries are now included in this updated report and will show by default. We’ve also included the columns for Project Status, Total Cost and Cost Rate Per Hour

- Bills with line items that are not assigned to a project will now be included in searches, to help you quickly find and assign expenses to relevant projects

New chart of accounts field in Xero HQ

You can now add a reporting name to accounts in the chart of accounts templates. This gives the account a different display name on reports and helps you enjoy better reporting from the start.

Send direct debit mandates in Xero

We’ve updated GoCardless in Xero so you can send direct debit agreements (mandates) to customers directly from Xero, without the need to send an invoice.

Payroll history now available in payroll settings — Australia

We’ve introduced payroll history to the payroll settings tab of Xero Payroll, so you can see any changes made by a small business owner, advisor or app partner.

Autocode incoming eInvoices — Australia & New Zealand

You can now allocate a code to eInvoicing suppliers, so line items from that supplier are automatically coded when you receive the eInvoice. You can still manually code individual items if you prefer.

Real-time data in Xero Tax — New Zealand

To make sure your pre-populated data is always up to date, we’re switching to real-time updates within Xero Tax. This will be automatically triggered when you create a new tax return in Xero.

Expanded income tax coverage — Canada

Income tax coverage in Xero now includes T1 Income statements (T2125 and T776), in addition to T2 and T5013. This will help advisors easily complete simplified year-ends for clients, thanks to TaxCycle.

The GIFI mapper has also been updated, to help you map accounts and balances to GIFI codes within Xero and export them for filing with the Canada Revenue Agency.

More banks added to Hubdoc — Canada & US

You can now use Hubdoc’s bank statement extraction tool if you bank with BMO, Chase Bank, CIBC, Royal Bank of Canada, Scotiabank, TD Canada Trust Bank or Wells Fargo.

Re-authenticate your bank feed in Xero — UK

The need to re-authenticate through your bank is finally a thing of the past. You can now re-consent to the continuation of your bank feed within Xero by following the prompts.

Split accounts and tax workflows in Xero Tax — UK

We’ve added the ability to split accounts and tax workflows, so you can prepare company accounts in Xero Tax and easily export the file if needed.