Unlocking the power of open banking: a simple and secure way to pay bills without leaving Xero

LAST UPDATED: Dec 20, 2023

Paying bills is a crucial part of the cash flow equation, and yet it’s usually a very manual process for small business owners. Getting bills into Xero, processing the payment and reconciling each transaction can take time away from important tasks, like growing revenue and managing costs.

There is also no standardised way for businesses in the UK to pay bills in bulk. Some banks accept payment files, while others don’t. At Xero, we’re on a mission to make this process easier and simplify the bill payment process.

Today, we’re excited to share that we’re launching a new bill payment experience in the UK. We’re the first major small business cloud accounting software in the UK to offer on-platform bill payments using open banking. This gives you a simple and secure way to manage, approve and pay bills, without leaving Xero.

The new bill payments experience

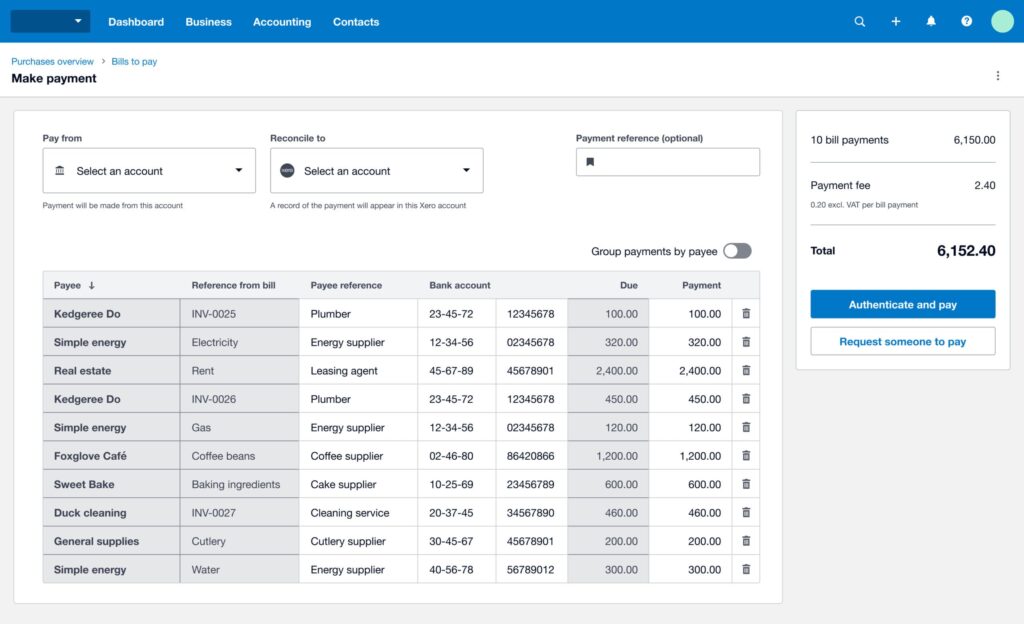

Our new bill payments experience means you can now complete your entire accounts payable workflow in Xero, from start to finish. There’s no need to pay each bill separately, fund external wallets and accounts, enter credit card details, or export payment files.

This not only saves you from a lot of the manual processes associated with paying bills, but also gives you real-time visibility of upcoming payments, so you can take control of your cash flow.

It’s free and easy to set up — all you need to do is connect your bank in Xero (don’t forget to check that your UK bank supports bulk payments via open banking). You’ll then be able to select ‘Direct bank transfer’ as a payment method to pay bills in GBP from your bank account, either individually or in bulk.

You’ll authorise all payments using multi-factor authentication directly from your banking app or online portal, giving you peace of mind when it comes to protecting your business from potential fraud. And if your employees or advisor are preparing bills for payment, they can easily hand them to you for final review and payment authentication, so you stay in control of your bank account.

Thanks to open banking, funds are available to your suppliers almost immediately. Best of all, there are no monthly subscription costs — once you’ve connected your bank account, you only pay when you select direct bank transfer as the payment method.

You can enjoy our bill payment experience free for 30 days if you sign up before 31 December 2023 (usually £0.20 per bill payment — price is in GBP and excludes VAT).

Powered by open banking

This feature is one that we know you’ve been waiting for — it’s been in our top 10 Xero Product Ideas for a while. The new technology is underpinned by open banking, which is quickly becoming a best practice standard in the UK for securely sharing financial data between banks and third-party providers.

Open banking moves us from a world where your bank controls the data they hold about you, to one where you own your data and can control how it’s used. It was introduced in the UK to encourage competition in the banking industry, and we are supportive of its long-term vision to empower businesses and consumers with ownership and control of their data.

For our bills payments experience, we’ve partnered with Crezco, a payment institution that’s authorised by the Financial Conduct Authority to provide open banking payment services in the UK. Crezco is responsible for providing all payment services when you pay bills by direct bank transfer in Xero.

As part of the set-up process, you’ll be asked to share some information with Crezco (via Xero) to enable open banking. This includes:

- your organisation information, including all users’ first names, last names and email addresses

- your bank account information, including account name, number and balance

- payment data, including the amount to be transferred, payee account number and sort code, so Crezco can process your payments

You’ll also need to log in to your online banking to complete the set up. This is all done securely and with your consent, every step of the way.

Making bill payments easier

We’re excited to offer this new bill payments experience to all Xero customers in the UK and can’t wait to hear how it’s helping you get accurate, real-time visibility of your bill payments, so you can better predict and manage your cash flow.

If you haven’t set up Hubdoc to automate the process of getting bills into Xero, or checked out our AI-powered predictions in bank reconciliation, it’s a good time to think about what other automation tools you can use in Xero to reduce manual tasks and save time on everyday admin.

Share this article

[addtoany]