Making Tax Digital for Income Tax: Multi-Business is Here!

I wanted to share a hugely exciting update on our Making Tax Digital for Income Tax (MTD for IT) beta, following the recent Autumn Budget announcements.

Our mission is to help you and your clients transition smoothly and confidently, and our recent progress shows we’re on the right track: our customer satisfaction scores on the public beta have exceeded all expectations. This success validates our commitment to quality, a robust product, and a seamless client experience.

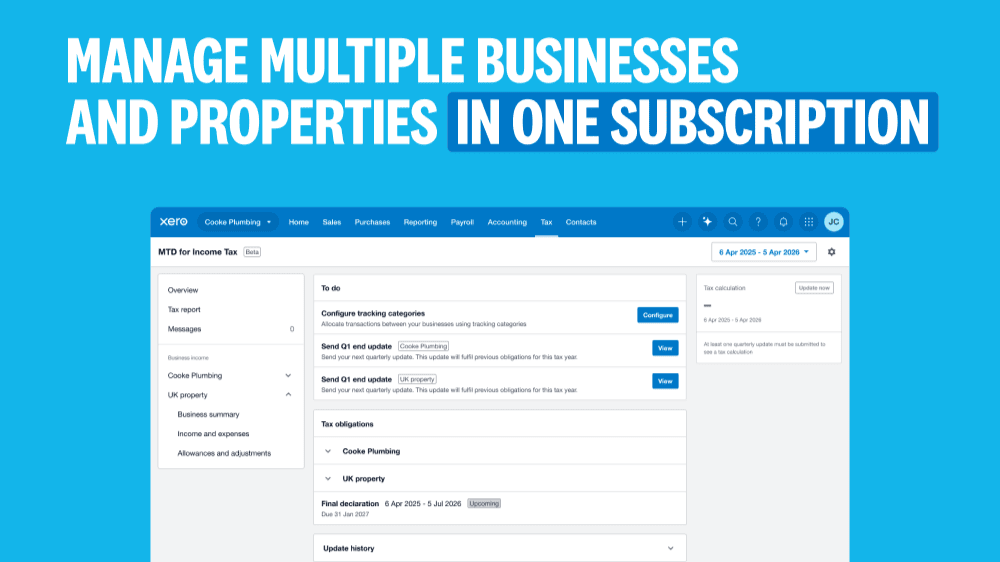

Building on this momentum, we are officially launching our multi-business functionality in the public beta next week! This is a major milestone and one so many have been waiting for.

- What this means: You can now manage multiple businesses, such as a self-employment and a property business, within a single Xero organisation.

- The benefit: This eliminates the need for managing and paying for multiple subscriptions, leveraging tracking categories to keep all quarterly updates separate and compliant.

This move exemplifies our philosophy of “build right, build once.” We are not rushing to market with incomplete tools. We’re prioritising a best-in-class, differentiated product that is robust, scalable, and delivers maximum benefit for the long term.

Autumn Budget and the digital mandate: time to get the process right

The recent Autumn Budget confirms the UK’s commitment to a digital tax future. The drive to digitise remains, and it’s time to get the underlying process right.

We know that implementing MTD for IT is a big change for small businesses. The mandate is still on course for April 2026 for sole traders and landlords with qualifying income over £50,000, with no delays announced. The key compliance date for the first tranche of clients is 6 April 2026.

The good news is that the government has acknowledged this shift by confirming a ‘soft landing’ for MTD for IT quarterly update penalties, assuring a grace period in the first year (2026/27) where taxpayers won’t face penalties for late submission of their quarterly updates. This is a valuable adjustment period – a chance to make MTD for IT less scary.

However, remember that penalties will still apply for late filing of the annual Final Declaration (due by 31 January the following year) and for late tax payments.

This is an opportunity to perfect your process without the immediate pressure of penalties. By starting now, your clients’ records will be accurate, reconciled, and ready to go when the final annual submission arrives. This drastically reduces the stress and rework associated with the traditional year-end scramble.

Don’t just bridge compliance – build a better business

A few of our partners have recently come to us for our thoughts on Bridging Software, particularly how it fits into the long-term MTD for IT strategy. We wanted to share our view more broadly on bridging compliance versus building a truly digital business.

While the shift to quarterly reporting may feel like “five times as much work,” the real long-term value for your clients is the opportunity to gain control and foresight over their business. Some practices may consider using Bridging Software to meet the MTD for IT mandate. While it offers a short-term, minimal digital link to HMRC, it acts only as a connector between a spreadsheet and the submission portal. It doesn’t provide any added benefit to the business, leaving your clients still doing time-consuming manual work like typing up bank statements or categorising transactions in an external document. This temporary fix for compliance means they miss out on the deep, ongoing benefits of a full cloud accounting solution.

Choosing comprehensive HMRC-recognised software like Xero, which is built for the end-to-end journey, transforms MTD for IT from a compliance chore into a strategic advantage.

This is where the power of Open Banking comes in. A full cloud solution, unlike a spreadsheet and bridging combination, connects directly to your clients’ bank accounts via Open Banking, providing automated daily bank feeds. This eliminates the need for manual data entry – no more typing up paper statements or spending hours categorising transactions in Excel. This saves massive amounts of time for both the client and the accountant, reduces errors, and ensures the data you are working with is accurate and available almost instantly.

By moving away from spreadsheets now, your clients get real-time visibility over their cash flow. This means it will be easier to spot a lack of profit after one quarter and implement changes immediately, or use a profitable quarter to plan tax-efficient purchases, rather than waiting for an annual shock. This shift unlocks proactive advice for you, giving you the high-quality data needed to guide clients toward smarter, more profitable decisions.

Ready to join the successful cohort?

To truly understand the smooth transition we’ve built, be sure to sign-up for Xero’s MTD for IT beta today.

How to join:

- Sign up with HMRC for the 2025–26 tax year to join the public testing phase.

- Register for Xero’s MTD Beta via our public beta hub.

We’ll place you in the next cohort and guide you through enablement, connection, and your first quarterly update.