In this difficult time, it has been pleasing to see our Xero community come together like never before. As always, we encourage you to reach out if you have a question or need some support. Behind the scenes, teams have been working around the clock to stay on top of the latest government changes around the world, and build features that will help you manage your finances in the months ahead.

A message from our Chief Product Officer, Anna Curzon

New features

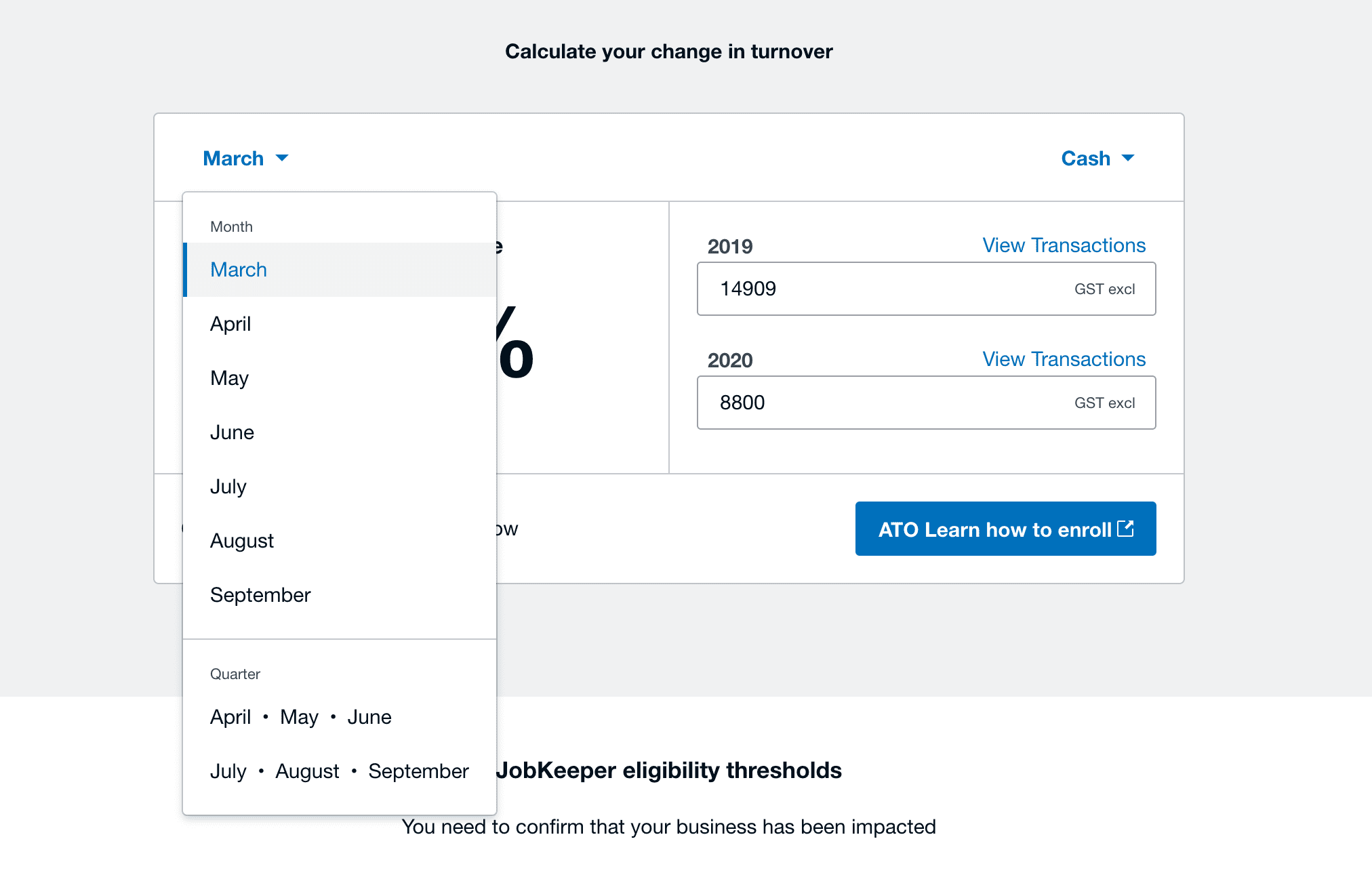

Calculate your eligibility for JobKeeper – AU

We’ve made it easier for businesses to work out if they might be eligible for JobKeeper payments, by building a GST turnover calculator within Xero. It automatically retrieves GST turnover data for your business, then shows the increase or fall between 2019 and 2020 for that period. You can also edit and reset the calculation.

https://www.youtube.com/watch?v=dGnaFh8GZ2E&feature=youtu.be

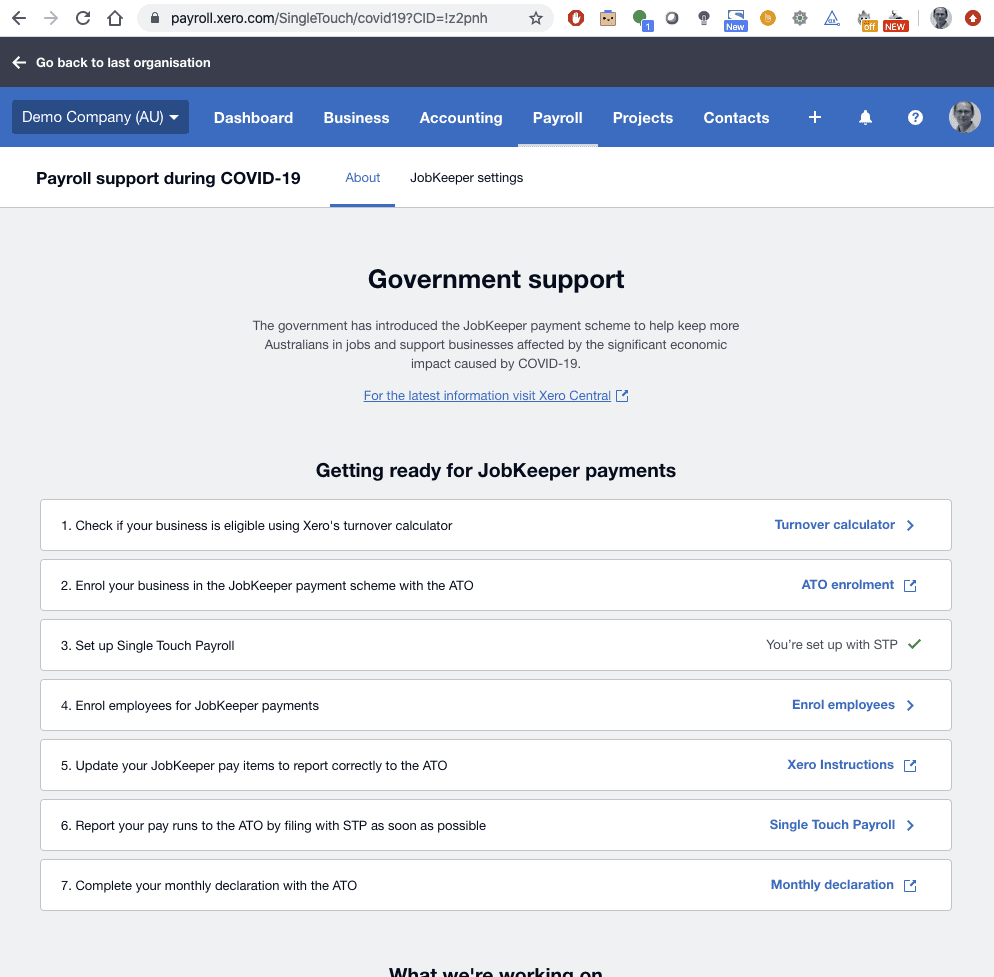

More JobKeeper support in Xero – AU

Our new payroll support page in Xero provides a list of actions you’ll need to take to process and file JobKeeper payments in Xero. It provides quick links to help you set up employees for JobKeeper and see who is enrolled in the program. You can also track their payments, file the data with Single Touch Payroll and more. You can access the page from the COVID-19 support banner in Xero Payroll.

Real-time visibility of payroll work – AU

Xero HQ Payroll helps accountants and bookkeepers stay on top of their clients’ payroll and compliance, with a single aerial view of all payroll tasks. It makes payroll work easier, faster and more efficient, so you can spend less time hunting for information and more time supporting your clients through this difficult time.

Streamline your tax return workflow – AU

If you’re an accountant or bookkeeper using Practice Manager in Australia, you can now create a new tax return for a client within a new or existing job, or create a standalone tax return without a job. This will save you time and provide a more streamlined workflow during the busy tax season.

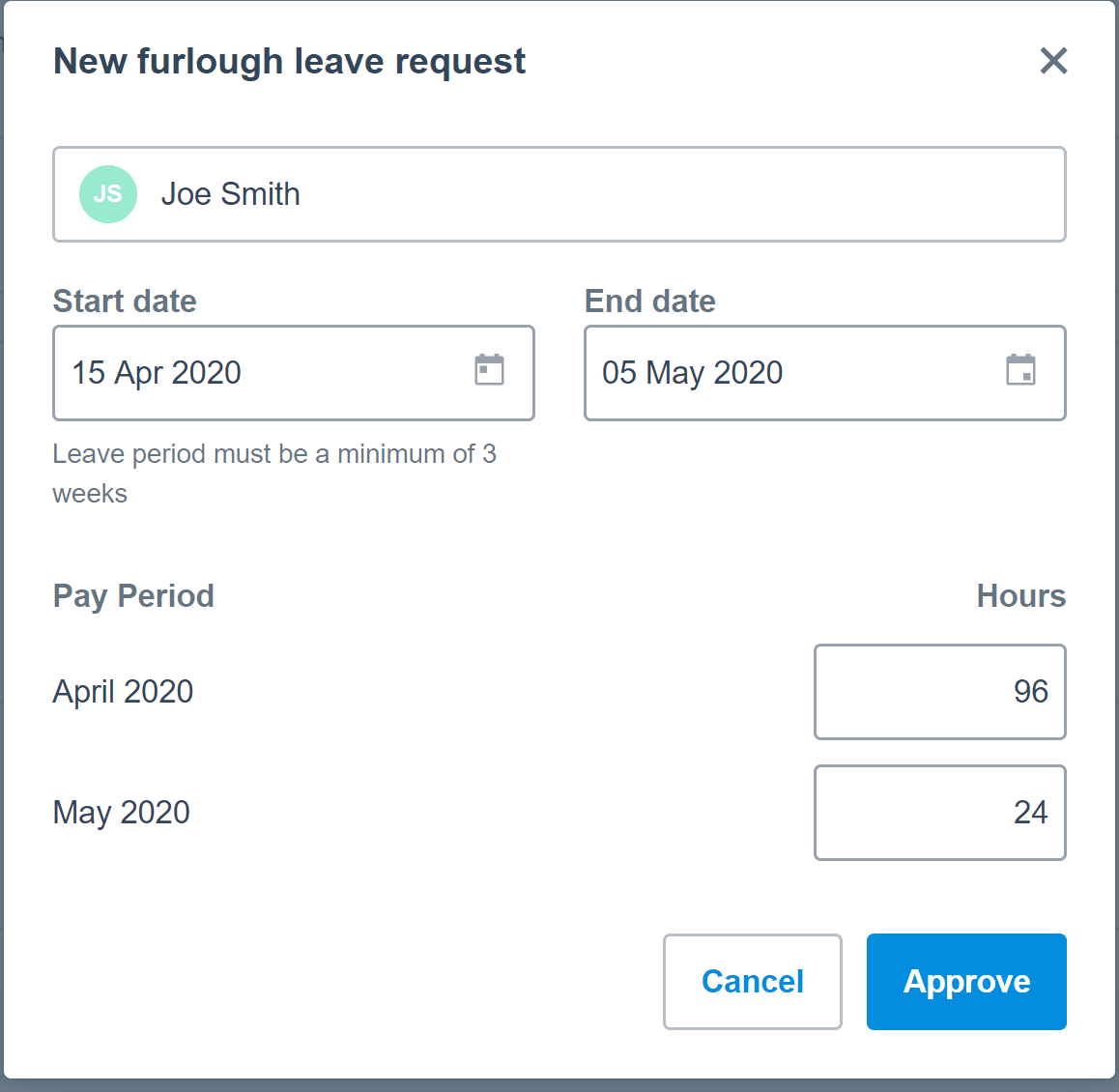

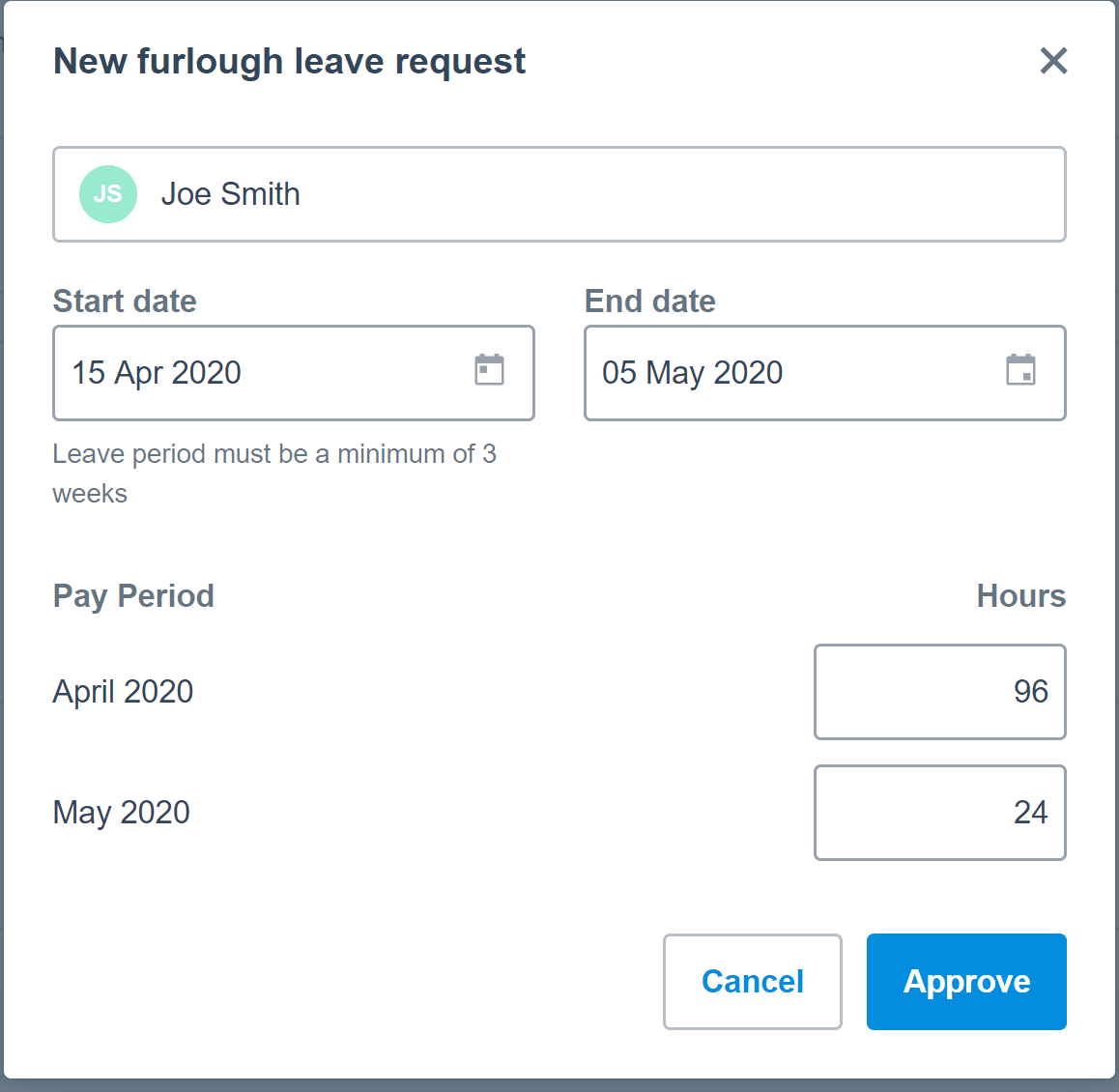

Process Furlough leave for your employees – UK

All Xero Payroll customers in the UK can now process furlough leave for eligible current or reinstated employees. The solution lets you easily allocate furlough leave to employees, then clearly split out the wage costs of furloughed workers in preparation for the grant claim. A report will soon be available within Xero for these claims. View a demo of furlough leave and COVID-19 sick leave tools in Xero.

Report on termination payments – UK

Our team has created a new termination pay item, so you can easily pay and report on your Class 1A National Insurance Contribution (NIC) on termination payments above £30,000 to HMRC. The pay item calculates the PAYE tax due for your employees and the NIC Class 1A due for you. HMRC is then notified of this termination payment through your monthly payroll reporting.

Manage invoicing on the go – UK

If you or your clients are in the construction industry, you can now send invoices from the Xero Accounting app* with Construction Industry Scheme (CIS) deductions automatically applied once a CIS account is selected, so your contractor knows exactly what to pay. The feature is available free of charge to all UK customers on Business Edition plans.

*available on 7.10.0 for iOS, and 3.65.0 for Android

Protect your data and privacy – Global

We’re 100% committed to protecting the data and privacy of our partners and customers, working with tax offices around the world on improved global security standards for digital services providers with add-on marketplaces. Xero Practice Manager and WorkflowMax app partners will need to complete a new security self-assessment questionnaire and upgrade to v3 of the API to meet the new standards.

Manage expenses paid with company money – Global

Company card reconciliation is a new feature in Xero Expenses which allows you to manage all employee spending in the one place. Employees can choose between using company or personal funds when submitting a claim, making it easier for you to identify non-reimbursable and reimbursable expenses and reconcile them appropriately.

Save time calculating mileage – Global

We’ve introduced a new mileage calculator in Xero Expenses that allows you to reimburse employees with confidence. Your employees can now add the start and end addresses into the calculator, which works out the distance travelled and generates a map that’s submitted with their expense claim. This saves you time and ensures mileage claims are accurate. Find out how to submit mileage claims using iOS or Android.

Coming soon

See where your business is heading – Global

Business Snapshot is a visual dashboard of key financial metrics, so you can quickly see how your business is performing. While it’s still in the pilot phase, we know how useful this tool will be during COVID-19. So we are extending the pilot to people with read-only, standard + reports, or advisor roles on Xero Business Edition plans over the next few weeks.

Pay and manage bills through Xero – UK

Pay with TransferWise is a new solution to help you pay and manage multiple bills. It means you can pay all your bills through Xero regardless of which bank you use, and reconcile transactions easily. When you sign up, you’ll be able to choose a plan to suit the number of bills you pay each month. We’ll be launching this solution in May 2020 and offering it to our UK customers free of charge until 31 July 2020.