Accessing finance for small business recovery

Last updated: Feb 24, 2024

Updated 31 March 2021 to reflect recent Government announcements

It’s no surprise that the need for small business borrowing in 2020 was significantly higher than in previous years. The government-backed Coronavirus Business Interruption Loan Scheme (CBILS) and Bounce Back Loan Scheme (BBLS) have now (as of March 31) closed, resulting in a lot of uncertainty.

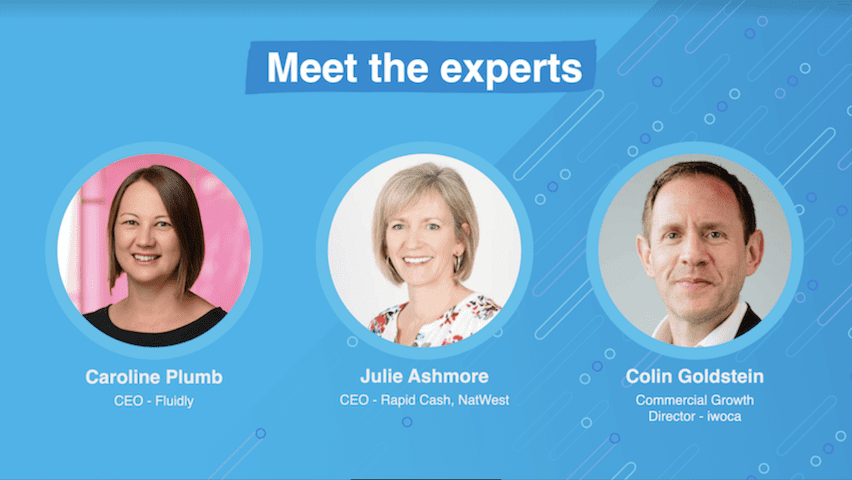

I recently hosted a live panel session with three experts to understand how businesses and their advisors can navigate the fast changing financing market. We discussed the current state, what options are available and tips for applying. I was joined by Julie Ashmore, CEO of Rapid Cash at NatWest; Colin Goldstein – Commercial Growth Director at iwoca; and Caroline Plumb,CEO of Fluidly.

Here are the key takeaways from the session. From the 4 March you’ll be able to watch the full panel discussion as part of Education Month.

The current landscape

The last twelve months have really forced the hand of lenders to step up and offer the right level of support for small businesses. Fluidly are seeing this first hand with the 40+ lenders they work with. Caroline Plumb commented, “There has been a real shift in small businesses thinking about the future, including taking advantage of the government schemes. However, since November there has also been a tightening of lender eligibility – with sector restrictions coming into play. This comes with its own set of challenges.”

Finding the right solution

It’s important that small businesses have access to finance options that fit their needs. A large percentage of small firms will need immediate short-term or mid-term finance in 2021, with the expectation that they might need finance again at some stage in the future. It often comes down to the risk appetite of the lender and sector restrictions, so getting the right guidance can be invaluable.

Although CBILS and BBLS have closed, new financial support schemes were announced during the 2021 Budget:

- A recovery loan scheme that replaces bounce back loans and CBILS where the government will guarantee up to 80% of loans from £25,000 to £10m. Applications for this loan will open on 6 April.

- A £5bn fund for restart grants of up to £6,000 per premises for non-essential retailers and up to £18,000 per premises for hospitality and leisure businesses. To apply for the restart grant scheme you must visit your local council’s website. You can find the website for your local council here.

- £700m for arts, culture and sporting venues to support reopening.

- Additional support for the self-employed. Claim a grant through the Self-Employment Income Support Scheme.

- Learn more about securing finance for COVID-19 recovery here.

Getting an advance on your unpaid invoices:

Think hard about your requirements. Do you need working capital or a short-term loan? Speak to your financial adviser and make sure you answer these questions upfront.

The real benefit of finance solutions for unpaid invoices (often referred to as invoice finance) is that you usually manage to raise more funds than a typical loan.

It’s often dependent on the lender’s risk appetite. It might be a “No” from one lender, it could be a “Yes” from another. It’s worth exploring multiple options with your financial adviser.

It typically used to be 30-90 days to get traditional finance for unpaid invoices, but now with services such as NatWest’s Rapid Cash it can be as quick as 48 hours according to Julie Ashmore. This is thanks to integrations with accounting software, such as Xero.

Alternative lenders like iwoca and MarketInvoice also integrate directly with your Xero account, meaning it can just take a few clicks to submit the required data.

Take a look at this guide for background information on finance solutions for unpaid invoices.

Resources to help navigate uncertainty

2020 was anything but predictable for businesses, and there’s still a tough road ahead. However, ensuring that businesses and their advisors have the right information and tools to plan for the future will make a world of difference.

Visit the Xero App Marketplace for more information about Fluidly, Rapid Cash, iwoca, iwocaPay and how they can help you, or your clients, access capital.

Visit our dedicated site for more resources, webinars and inspirational stories to help you navigate the COVID-19 pandemic.

Some of this information has been taken directly from Gov.uk and is subject to change. Please look out for future updates from the government. See more on our Behind Small Business Hub.