Canadian CEOs conquer Cash Flow anxiety and grow with Xero

Growing a small business is exhilarating, but the reality of managing its finances can be exhausting. From juggling invoices and tracking expenses to facing year-end taxes, the financial burden often pulls entrepreneurs away from the work they love—and the work that drives growth.

We partnered with BetaKit to showcase the unvarnished stories of two Canadian CEOs who turned their financial operations from a source of stress into a strategic advantage: Emrah Eren of Duco Media and Sean Hoff of Moniker. They share how moving to cloud accounting not only solved their immediate problems but empowered them with the confidence and data to scale their companies.

Hear Their Stories

Emrah Eren, CEO of Duco Media: Conquering the Fear of Year-End

See how Ottawa-based digital marketing agency Duco Media transformed its financial clarity and achieved impressive growth with Xero.

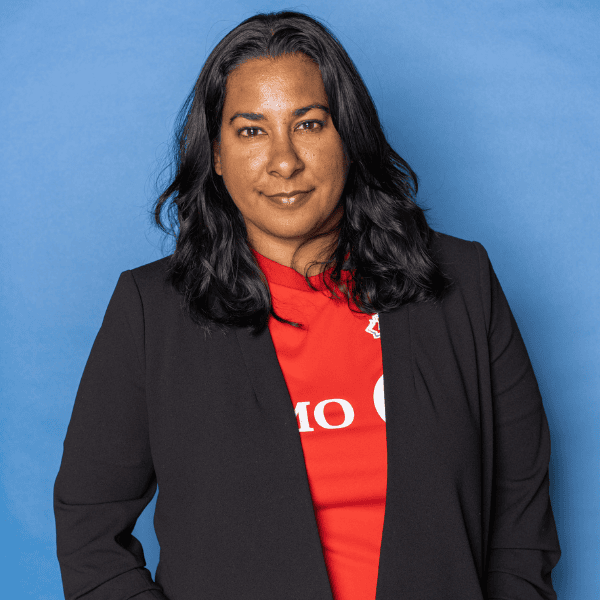

Sean Hoff, CEO of Moniker: Gaining Real-Time Visibility in a Global Business

Discover how Toronto-based corporate retreat company Moniker found the solution to managing complex multi-currency transactions and business growth.

The Chaos of Growth: When Excel Sheets Fail the Entrepreneur

For many small business owners, financial management is a source of anxiety, not confidence. Both Emrah Eren and Sean Hoff faced a common experience: their makeshift financial systems simply couldn’t keep pace with their growing businesses.

For Duco Media, the breaking point wasn’t daily bookkeeping, but a high-stakes funding application during the pandemic. Emrah recalls the painful process of trying to compile the necessary financial statements, which took “hours and hours and hours to produce…”. The sheer difficulty forced him to ask his accountant for a better way.

Moniker’s challenges were amplified by its international scope and rapid expansion—going from 6 or 7 projects to over 20 in a single year. The complex logistics led to a catastrophic lack of visibility. Sean described the feeling of being an entrepreneur without a clear financial view: “You feel like an air traffic controller trying to stay on top of all of these flights that are coming in and out, but half your screens are dark.”

Strategic Relief: Finding the Right Tool for the Job

The key for both CEOs was finding a tool that addressed their specific anxieties and operational complexities.

For Sean Hoff, running a corporate retreat company meant constantly dealing with multi-currency transactions. This complexity demanded a specialized solution, leading Moniker to choose Xero for its core flexibility. Sean highlighted this as a core business enabler: “It was one of the few accounting platforms that allowed multi-currency. We might be getting paid in Euro but taking a group to Mexico, so we’re paying out in Pesos.”.

For Emrah Eren, the impact was deeply personal and immediately psychological. Beyond just the mechanics of bookkeeping, Xero removed the constant worry. He noted a profound relief that many business owners can relate to: “Xero has removed not only the burden of financial management, but I’d also say the fear of a year-end.”

The Outcome: Confidence and Measurable Momentum

Shifting from reacting to financial problems to proactively planning allowed both businesses to accelerate their growth with confidence.

Sean Hoff emphasizes that visibility transforms decision-making, particularly around cash flow. Reliable data now allows Moniker to forecast accurately and set realistic expectations.

Duco Media saw measurable momentum: their efficiency skyrocketed, with complex, year-over-year financial reports now taking “within a few seconds.” Emrah links this new operational speed directly to their success, resulting in 120% growth in revenue in the first year and a 40% increase in timely payment collection.

For these CEOs, the right financial software wasn’t just about accounting—it was about reclaiming control, easing anxiety, and setting the stage for aggressive, reliable business scaling.