New features announced at Xerocon Nashville

Last updated: Nov 26, 2025

Running a small business in the US or Canada comes with its fair share of unique challenges. That’s why Xero has been doubling down on building out our product capabilities for the unique needs of this region.

Today, on stage at Xerocon Nashville, I was very excited to unveil the huge number of improvements Xero has made to make things easier for small businesses and their advisors. These improvements support more streamlined accounting, enabling small businesses to save time and have greater control over their cash flow. Here’s a look at what we announced.

Our accounting solution just got better

We’ve been listening closely to your feedback and have put a significant amount of resources into adapting our software and improving the areas small businesses and accountants and bookkeepers use the most. We believe that by prioritizing the essentials, we can have the biggest impact on user experience and make them best in class. I’m excited to share our progress. Here are some of the key improvements we’ve made based on what you’ve told us is important to you:

- An enhanced bank feed experience [US & CA]: You asked us to improve the quality of bank feeds, so we’ve heavily invested in that area. Over the last 18 months, we’ve increased the number of direct bank feeds from 20 to over 700 banks in the US and Canada, making it easier to pull your data into Xero. But we’re not stopping there. Over the next year, we intend to add hundreds more direct feeds. We’ve been able to quickly grow our network through the help of large aggregator platforms like Flinks and Yodlee, which are increasingly able to provide more direct bank connections at scale.

- PDF import [US & CA]: We’ve developed a PDF statement import functionality, to provide more ways to get bank statement data into Xero from our customers’ most popular banks in the US and Canada. Simply upload your PDF bank statements directly into Xero. Xero then extracts the bank data from the PDF in an average of just 35 seconds, ready for you to review and the data before it’s imported.

- [Coming soon] Bank reconciliation to a period [US & CA]: I’m especially excited to see this one roll out in the next couple of months as we know it’s something accountants and bookkeepers have been asking for. This feature will enable you to close out a period in Xero by matching coded transactions back to your bank statement period. You’ll be able to specify a date range and set an opening and closing balance from your bank statement. This will help you quickly spot and resolve discrepancies between bank statements and Xero entries, ensuring your financial data is always accurate and up-to-date, and you can feel more confident in the reports you create for your clients.

- [Coming soon] Improved bank feed monitoring [US & CA]: While we can’t control how often a bank is offline, you’ve told us that you want to know when a feed is down as quickly as possible. In the next few months, we’ll make it easier for you to monitor the status of bank feeds in Xero. You’ll be notified of any disruptions during bank feed set up, and can report bank feed issues directly to us with the click of a button.

- [Coming soon] Localized charts of accounts [US]: Xero will soon offer charts of accounts tailored to specific US business types (such as C-Corp, S-Corp and LLC) directly to new users, along with an enhanced trial balance report that enables users to set custom date ranges, more closely meeting the unique needs of the US market.

These updates are just the beginning. We’re dedicated to continuously improving Xero to make it the best accounting solution for North American businesses.

Get paid faster and improve cash flow

With cash flow being top of mind for you and your clients, we’re also investing in getting paid and making payments.

- Get paid in more ways [US & CA]: In partnership with Stripe, Xero is equipping small businesses to offer their customers flexible payment options, including direct bank transfers (US only) and buy now, pay later choices, in addition to credit cards, debit cards, and digital wallets.

- [Coming soon] Tap to Pay [US]: Early next year, in partnership with Stripe, small businesses will be able to create an invoice and accept payment on the spot using their mobile device – perfect for businesses that are out and about.

- [Coming soon] SMS invoicing [US initially/ Rolling out to further regions post-launch]: Available in beta later this year, small businesses will be able to send invoices directly to their customers’ phones, making it even easier for them to pay promptly via Apple Pay or GooglePay.

- [Coming soon] BILL beta [US]: Xero’s upcoming embedded bill payment feature, powered by BILL, will let your clients pay vendors directly within Xero using ACH transfer, credit/debit cards, or checks. This will save valuable time on administrative tasks and give small businesses greater visibility and control over cash flow. Check out the demo video below:

Being able to make and collect payments without leaving Xero is a powerful tool for your clients. It gives them a complete picture of their cash flow so they can make informed decisions about their business.

Enhanced sales tax and compliance features, and powerful client insights

We’re continuing to invest in freeing up accountants and bookkeepers to focus on advisory by releasing a suite of new features, including:

- Easy W-9 Collection [US]: Accountants and bookkeepers can now request W9 information directly from the contact page, as well as manually mark W9s as received, either one by one or in bulk. We’ve also revamped the workflow for completing W9s, making it easier for vendors to fill them in and return them faster, making 1099 preparation more seamless.

- Expanded state-based sales tax reporting [US]: You’re now able to generate sales tax reports for every state and filing period automatically. These reports are created and populated with your clients’ data for each state and filing period, giving you the data you need to file your clients’ sales tax, saving you time and reducing stress.

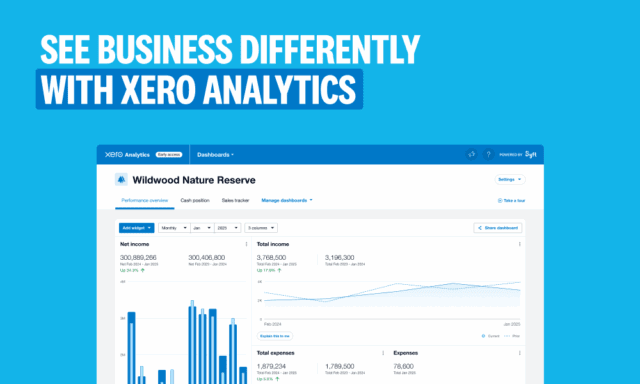

- [Coming soon] New client insights dashboard [US & CA] : Available soon in Xero Practice Manager and Xero HQ, the client insights dashboard will give you a snapshot of the financial health metrics and trends for all your business edition clients.

New partnership with audit and accounting platform, Caseware [CA]

We announced an exciting new integration partnership with Caseware, a global provider of cloud-enabled audit, financial reporting and data analytics solutions. This will allow our shared customers in Canada to import trial balances and general ledger data from Xero into Caseware Working Papers.

The integration, set to launch later this year, will save clients precious time and streamline year-end workflows. This means less manual data entry and more time for you to focus on what you do best: supporting your clients and growing your practice.

Accounting on the go with AI and mobile

Our vision is to reimagine accounting by using generative AI and mobile technology. We shared a range of new updates to the Xero Accounting mobile app and unveiled our new GenAI smart business companion Just Ask Xero (JAX), which will enable small businesses and their advisors to complete business tasks on the go.

Read the blog post about how AI and mobile technology will reimagine accounting to find out more.

Introducing a new Amazon integration and full release of Xero Inventory Plus [US]

On Thursday, we were excited to launch a new integration with Amazon that’s coming soon to our new inventory management solution, Xero Inventory Plus. This integration comes as we’ve moved from the initial early release product to general availability. The new tool helps small goods-based businesses in the US easily track and manage their inventory across multiple locations and sales channels, giving a clear picture of business performance.

Inventory Plus will enable users to automate time-consuming tasks, manage the complete fulfillment process, and effortlessly connect with new sales channels like Amazon, and the existing Shopify integration. This product is a key component of Xero’s product expansion in the US and will be a game-changer for small businesses looking to grow and thrive.

These announcements underscore Xero’s dedication to addressing the specific needs of our customers in the US and Canada. We’re committed to providing solutions that simplify accounting, streamline compliance, and empower businesses to thrive. We’re excited about the future in the US and Canada, and look forward to continuing to support your success.

Was this article helpful?

YesNo