Your ultimate payroll year-end 2024/25 checklist: steps and deadlines

Last updated: Dec 18, 2024

It’d be one thing if payroll year-end meant a single last pay run. But this busy period involves meeting multiple deadlines and submission dates, all while following HMRC rules. Whether you’re a seasoned payroll manager or doing it for the first time, payroll year-end can be tricky. Here’s a step-by-step guide to the process.

What is HMRC payroll year-end?

Payroll year-end is when a business finalises payroll records for the tax year. Think of it as closing out your payroll for the period: you’re reporting to HMRC the total amount you’ve paid your employees and the deductions you’ve made, which is necessary admin before starting a new tax year.

Every twelve months following your final pay run, you’ll need to send specific information to HMRC: a Full Payment Submission (FPS) and possibly an Employer Payment Summary (EPS). You’ll also need to issue P60s to your employees and make any adjustments to tax codes for the new tax year.

A step-by-step guide to year-end

1. Check when your payroll ends

The usual payroll year-end date falls on 5 April. However, each business pays their staff over pay periods that work for them, meaning that some pay monthly and some weekly, or within a weekly multiple. You can do payroll year-end before 5 April. You must submit reports to HMRC on or before your employees’ final pay day of the year (which will most likely be before 5 April).

Keep in mind: it’s better not to rush these processes. Make sure you have the right, complete information so you don’t need to make adjustments after submitting.

2. Verify leavers and new starters

New employees might have joined the business, and others might have left. Now, more than any other time in the year, is the time to know exactly who is on the payroll. Make sure to communicate clearly with managers so that nobody gets missed or any dates confused.

Timing is important. This task needs to be done before submitting your Full Payment Submission (FPS) or Employer Payment Summary (EPS) or else you’ll likely tie yourself in knots trying to go back and change these details.

3. Conduct your final pay run

Just as you’ve been doing throughout the tax year, you’ll need to complete a final pay run. If you no longer have employees to pay, you must process a pay run for nil payments.

It’s worth noting: the payment date must fall in month 12 (generally between 6 March and 5 April).

Once you’ve done your final pay run, and made sure you’re up-to-date on your starters and leavers, you need to send the final FPS and, if needed, EPS by 19 April. Double check your submissions before the deadline to try and avoid any possible errors.

4. Finalise your payroll year-end process

Most payroll software will help process your year-end. For example, if you’ve done your final pay run before 19 April, Xero will automatically submit your final EPS to HMRC for you. This will happen between days 12 and 19 of the month, in time to meet the 19 April deadline. When you set a cease date, Xero will record this in your EPS.

If you need to make a correction or forget to make a claim, it’s important to do so by 19 April. See more info here.

5. Prepare and give out P60s

A P60 is a document that summarises how much an employee has earned, plus how much tax and National Insurance Contribution they have paid, in a year.

All employees who worked for a business on the final day of the tax year must receive a P60 by 31 May. It’s the employer’s legal duty to provide the document by this deadline. Once the final payslip and any corrections are complete, it is time to issue P60s.

P60s will be available in Xero payroll from the end of March.

6. Transition to the new payroll year

So you’ve taken care of your HMRC submission and P60s. Now you can prepare for your new payroll year by looking at the P9X. This government document tells you the latest personal allowance and tax codes so you can update your processes starting from 6 April.

It’s a good idea to check certain thresholds and processes, even if these are included in your software. That way you can feel confident everything is under control. For example, pay attention to the following:

- The threshold for student loan and postgraduate loan repayments

- CA2700 certificates for deferred National Insurance which must be renewed each year before you can process an employee’s pay for the next tax year

- Childcare vouchers that might need to be reviewed – double-check employees don’t need a change in the value they are eligible to receive. HMRC asks employers to complete a Basic Earnings Assessment (BEA) in advance of each first pay period in a new tax year

Key dates and deadlines for payroll year end 2025

Calendar reminders can save a lot of stress when keeping track of important deadlines. Consider setting up alerts to give yourself enough warning for the following:

- 5 April 2025: 2024/25 tax year-end

- 5 April: The last day to update your employee payroll records and your payroll software

- 6 April: The new tax year for 2025/26 begins

- 19 April: The deadline for the final submission of the 2024/25 tax year

- 22 April: The deadline for month 12 PAYE

- 31 May: The deadline to send your employees their P60s

- 6 July: The deadline to report on expenses and benefits (using your payroll software if applicable)

- 6 July: The deadline to submit your P11D and P11D(b) forms

- 22 July: The deadline for payments of class 1A National Insurance Contributions on benefits in kind to HMRC (If you’re not using digital systems, the deadline is 19 July)

Streamline year-end payroll

Navigating year-end payroll requires preparation. Understanding common challenges and knowing how to overcome them for a smoother year-end process can be a big help in getting started.

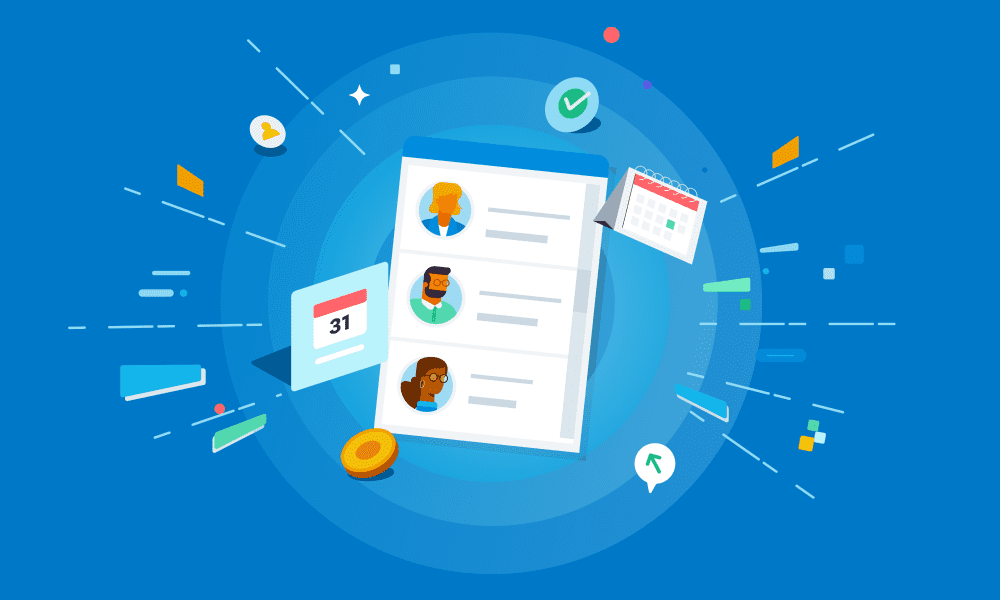

Using software that is HMRC-recognised, like Xero, can streamline payroll and simplify compliance. Features such as automated RTI submissions, simple adjustments and automated payroll calculations keep records accurate and up-to-date. With all necessary data securely stored in one place, you and your team can access it anytime, from anywhere, for seamless collaboration. This results in a smoother payroll process with less stress and greater confidence.

For more info, check out our payroll software for small businesses.