Streamline tax time: Xero now supports partnership tax in the UK

We’re excited to announce that partnership tax has arrived in Xero Tax. You can now manage most of your clients’ tax needs – corporate, personal, and ordinary partnerships – in one simple, secure platform. No more juggling multiple tools or battling complicated software. By managing partnership tax in Xero, you can remove some of the stress around tax time for your practice and your clients.

Unlocking the benefits of Xero Tax

Partnership tax can be quite complex, with various rules and regulations regarding profit-sharing, individual partner tax liabilities, and filing requirements. This can be a headache for businesses, and a very manual process for you as their advisor. For example, partnership tax often involves manual data entry, calculations, and reconciliation across different platforms. This takes valuable time away from core business activities and using multiple tools or relying on spreadsheets creates inefficiencies and potential for data discrepancies.

Your practice can now gain all the benefits of Xero Tax across your ordinary partnership clients. The benefits of this addition include:

- Saving time: reduces manual data entry by pulling directly from your client’s bookkeeping data in Xero.

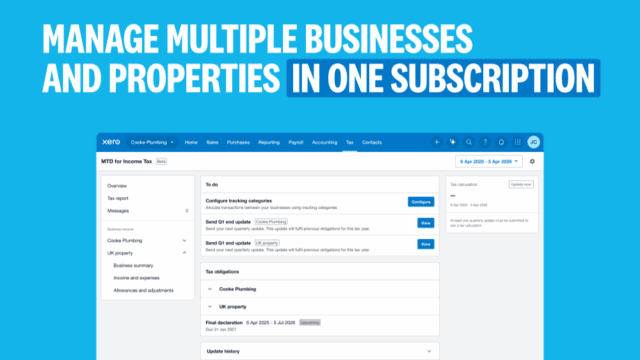

- Simple and efficient: Xero streamlines partnership tax management by bringing everything into one platform, making it easy for the whole team to use and collaborate on tax returns together.

- Use Xero Tax for more of your clients: Xero Tax is designed to make it easy to prepare accounts and tax where your clients are using Xero. However, if a client is not using Xero, you can still prepare company accounts and tax and partnership tax by adding their data to a Xero ledger and connecting to Xero Tax.

- Better job planning and timely submissions: You can now more holistically view and manage tax obligations across your client base, giving you a quick snapshot of when your client obligations are due or yet to be filed.

- Enhance your client reporting: You can add more value by creating professional, customised annual accounts at both client and practice level with flexible formatting options to match your service offering.

Don’t just take our word for it

Accountants and bookkeepers have been benefiting from using Xero Tax for some time. And practices that will also use it for partnership tax will now be able to reap these benefits.

Emma Reid, Partner at Cottons Group implemented Xero Tax in their practice earlier this year, and has already seen the impact of increased efficiency.

“Since rolling out Xero Tax and reviewing our systems and processes, we are now at least one month ahead in tax return preparation compared to last year. Our improvements have not only enhanced efficiency but also positioned us to meet deadlines while fully addressing client needs. As we approach January 31st, our workload feels manageable, last-minute pressures seem avoidable, and our staff can focus on our growth initiatives.”

Andy Housley, owner of Square 1 Accounting, has always harnessed the power of digital tools in his practice to help make life easier for him and his clients. He explains how with Xero Tax, he already had a one-stop solution for company and personal tax, but now he no longer has to flip between different tools or spend money on extra software to serve partnership clients.

“The thing I’ve always liked about Xero is that it’s simple and it works. Everything is very user-friendly. Before I used Xero Tax, it could take an hour just to get to the point where I could start producing the tax return. Now I can do the whole thing in 20-30 minutes.” he says.

He found filing his first partnership tax return a breeze, too. “The way Xero has structured it is brilliant. It’s clean, it’s simple, it works.”

The first partnership tax returns he completed using Xero Tax were so straightforward he initially thought he must have missed something. “It was that fast, I had to go back to make sure I’d done it right.”

How to get started using partnership tax

Partnership tax is available to all Xero partners at no additional cost to you or your clients. If you haven’t yet tried Xero Tax, with the addition of partnership tax now is a great time to give it a go and avoid juggling multiple systems – and reduce the urge to tear your hair out this tax season.

To find out more about becoming a Xero partner, visit our partner programme page, or to access partnership tax see our help article about how to get started.

Visit the Xero Tax page for partners to find more resources, like our case studies and downloadable all-in-one tax guide, to see how everything works together in Xero.