With the new financial year officially upon us, now is your chance at a fresh start. This means it’s time to revisit goals, set intentions, and level up in order to make the most of the next 12 months. A good place to start? By optimising your systems and processes to create more seamless workflows and win back time.

To help you set off on the right foot, we’ve rounded up a list of ways to work smarter in Xero. Take what you need from these tips and tricks to stay on top of your numbers, and remember, your financial advisor is always there for more support should you need it.

1. Automate data entry with Hubdoc

If you’re looking to save time and streamline data entry, Hubdoc could be the tool for you. The data capture software makes it easy to keep track of bills and receipts and automates the process of entering them in Xero.

You can email, scan or take photos of documents via the Hubdoc mobile app to store in Xero. It will then extract key data, like a supplier’s name, tax rates, invoice numbers, amounts, and due dates. You just need to tell Hubdoc how you want to publish the information in Xero to easily match it in your bank feed. Plus, Hubdoc helps you go paperless by storing bills and receipts digitally, and in one central place.

2. Pay invoices faster with batch payments in Xero

When it comes to paying bills, traditional methods (like manual bank payments) can be slow and monotonous, especially when you need to make several payments. So, why not try batch payments in Xero to speed up the process?

With batch payments, you can bundle several bills into one payment file before importing it into your bank account for processing. You can schedule payment dates in Xero and customise what details you want to appear on both your bank statement and your supplier’s. If their bank account details are saved in their contact record, this information will carry across automatically. If not, simply enter the account details manually where they’ll be saved for the next time you schedule a batch payment, minimising the need for manual data entry. To learn more, check out Xero Central.

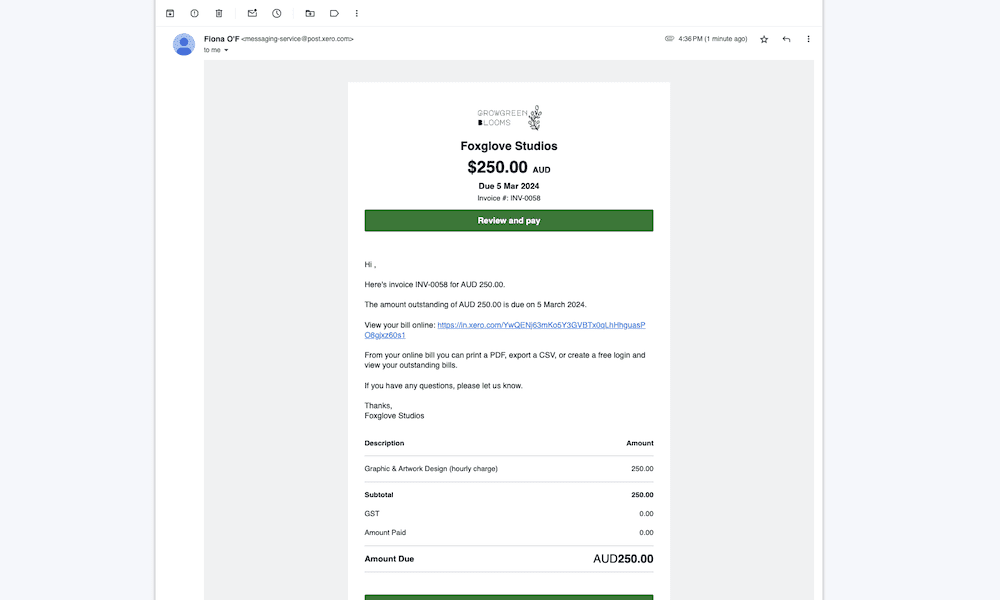

3. Get paid up to twice as fast with online invoice payments

Did you know that up to 45% of invoices from Kiwi small businesses are paid late? An easy way to minimise this risk in FY25 is by adding a ‘Pay now’ button to your online invoices. This will give customers more ways to pay – be it via credit or debit card, direct debit, or Apple Pay and Google Pay – so that you can spend less time chasing payments.

Start by connecting to your preferred payment providers. Once connected, they will automatically add to your existing Xero branding themes (also known as invoice templates), or you can manage them directly from your invoices. The best part? Online invoice payments can help you get paid up to twice as fast. Plus, the setup is simple, quick and free.

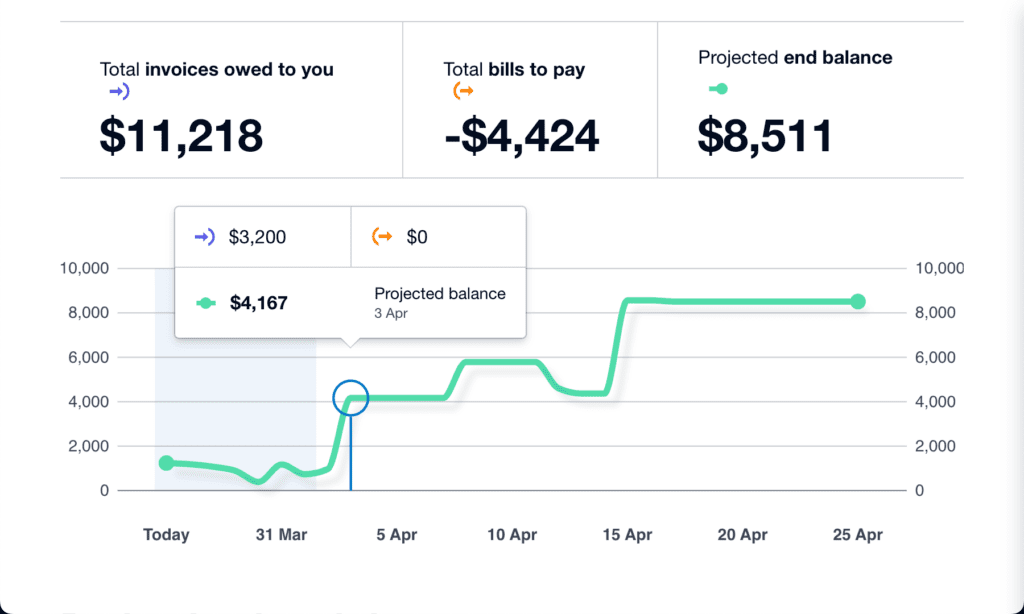

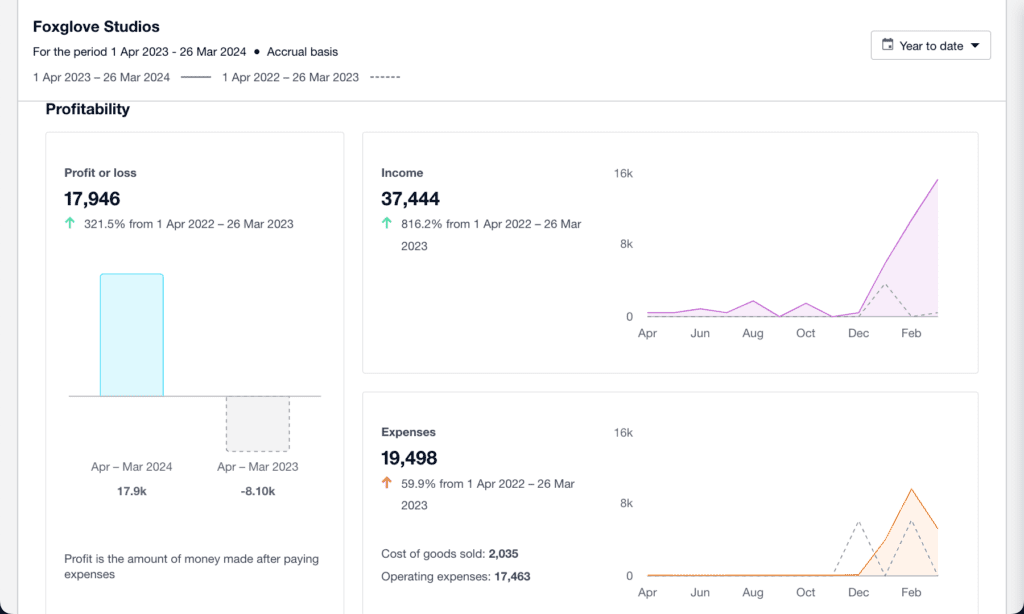

4. Make data-driven decisions with Xero Analytics

If tracking cash flow wasn’t a priority last financial year, now’s the time to make it part of your routine. Here’s where the Xero Analytics short-term cash flow tool can help. It draws on the balance of your selected bank accounts and the upcoming bills and invoices you’ve entered into Xero to generate a cash flow projection for the next seven to 30 days. This big-picture view can help you make smarter financial decisions.

The Business snapshot dashboard is another tool in Xero Analytics for an instant, one-page overview of your organisation’s financial wellbeing. It tracks information like profitability, income, largest operating expenses, key financial metrics, and more to evaluate how well your business is running so that you can have more informed conversations with your advisor.

If you want to take your data-driven decision making to the next level, there’s also Xero Analytics Plus, enabling deeper insights like cash flow projections of up to 90 days, and much more.

5. Streamline reconciliation with bank rules

To save time and minimise errors in the reconciliation process, consider creating bank rules for recurring cash transactions. Whether it’s a regular expense like filling your work vehicle with petrol or paying a monthly bank account fee, you can create bank rules that are targeted enough to identify these transactions, and tell Xero how you want to code them.

When a transaction comes through your bank account in Xero that fits the bank rule’s conditions, you can reconcile it in just one click. You can also create bank rules from existing transactions to give you a head start in setting them up. Useful, right?

Check out this guide for more ways to win back time this financial year. Xero’s EOFY hub also has some valuable resources, webinars and tips, so be sure to take a look at what’s on offer. Here’s to making FY25 your best year yet!

Share this article

[addtoany]