Five tips to improve your business credit score

Last updated: Apr 29, 2025

As a small business, your credit score signals to lenders, vendors, and investors how well you manage debt. Building a strong business credit score can be simple, and it often comes with major benefits:

- Get approved for bigger loans and higher credit limits at lower interest rates

- Enjoy more favourable terms for rent, insurance, and vendor/supplier contracts

- Qualify for public and private contracts

Yet even with these advantages, many business owners don’t know how to check their business credit score, let alone intentionally increase it. If that describes you, here’s everything you need to know to get started.

How to check your business credit score

First, make sure you’re registered with the major business credit reporting bureaus; in the US, the main ones are Dun & Bradstreet, Experian, and Equifax. Each uses their own scoring system, but they calculate your creditworthiness based on the same information.

Once registered, you can request a credit report directly from the credit bureau, which typically comes with a fee. There are also online platforms that allow members to check their credit reports for free. For each metric, a higher score indicates lower risk, and vice versa.

Five ways to increase your business credit score

You’ll typically have a strong credit profile after three years of paying bills and debts on time. If your credit score is low, your business is young, or you simply want to qualify for better loan and vendor terms, follow these tips to avoid common mistakes and increase your US business credit score faster.

1. Automate your business bills to avoid missed payments

The easiest and most effective way to increase your business credit score is to pay recurring bills and credit repayments on time. An accounts payable platform like Xero automates both your recurring bills and non-recurring or variable bills.

2. Keep your personal and business finances separate

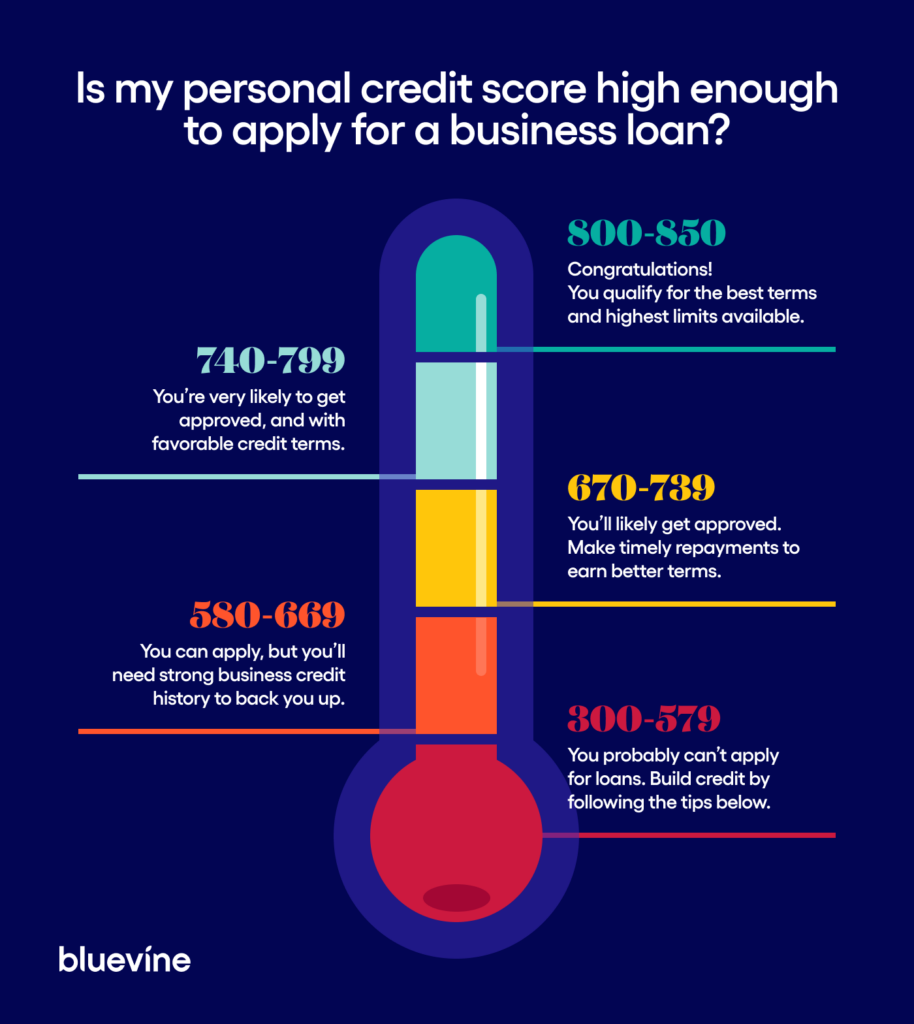

While assessing your creditworthiness for a business loan, lenders will usually check both your business credit scores and personal credit score, especially if you’re a new business owner without years of payment history.

Figure 1. US credit scores range from 300 to 850 with a higher score representing your business as being a lower credit risk.

Keep your personal and US business finances separate by incorporating your business and opening a business checking account. This will help simplify your business finances (especially at scale), streamline your taxes, and protect you from being liable for business debts.

3. Open a line of credit or credit card – but don’t max them out

If you’re having difficulty getting approved for business loans, a business credit card from your bank or checking provider is an easy way to demonstrate that responsibility. Purchases made by credit card can also earn cash back and other rewards, easing cash flow.

Once you’ve built some credit history, applying for a line of credit can help you cover seasonal fluctuations in revenue or payments, or jumpstart a new initiative.

Repaying your credit card or line of credit in full and on time will increase your business credit score, but using high percentages of your credit can lessen that increase. Keep your debt ratios below 30%, and pay them off early if you make a large purchase.

4. Keep your finances simple and consistent

It’s unlikely your business needs more than one business checking account, line of credit, and credit card. Having too many credit streams, opening or closing multiple banking accounts, and other such activities reflect poorly on your credit report, and needlessly complicate your finances.

5. Regularly monitor your credit report for mistakes

If there are changes to your business information, such as DBA name, address, or ownership stake,

be sure to update your credit profiles with all three business credit bureaus as soon as possible.

Check your business credit profiles at least once a year to see whether vendors are reporting your payments correctly, and ensure that anyone doing a credit check on your business sees accurate information.

Tip: Ensure your banking and accounting platforms have up-to-date security measures such as biometric sign-in, multi-factor authentication, and at least 256-bit encryption to avoid any fraudulent activity appearing on your credit report.

Build a credit profile for the future

Overall, a strong business credit score indicates to lenders and vendors that you’re more likely to repay money you borrow. By following the tips above, you can build a business credit profile that sets you up for success, making you more likely to get approved for credit and loans in the future.

Bluevine is an online banking platform designed to help small businesses simplify their financial management – including time-saving accounting integrations with Xero – so they can spend less time banking and focus more on what they love.

As a Xero customer, you can get a three-month free upgrade to Bluevine’s Plus or Premier plan when you open a business checking account. Meet certain eligibility requirements to receive an additional $300 sign-up bonus. This offer is only available to Xero customers based in the United States. Apply now

Information from third-parties or their websites shared in this bulletin is not affiliated with or endorsed by Xero and Xero is not responsible for the accuracy or completeness of any such information. We may provide you with information we think might be useful in running a small business, but this should not be seen as a substitute for professional advice. You are responsible for any acts you choose to take or not to take relying on such information.