Four ways to manage your cash flow with customer credit limits

Updated: 15th February 2021

One of the biggest issues facing small businesses globally is poor cash flow. Even before COVID-19, industry data showed that the majority of businesses who close their doors cite cash flow issues as the main reason. A Xero report published in June 2019 also showed that 30% of small business owners fear they don’t have enough money to pay themselves or their employees. Add a pandemic to the mix and it’s clear that cash flow is going to become even more important in the years ahead.

Reducing the amount of risk you take on with customers is a big part of managing your cash flow and something our teams have been working on for a while now. It’s all about visibility and control: visibility over which customers owe you money so you can chase payment, and control over the amount of credit you extend to those customers in the first place. Our customer credit limits feature in new invoicing helps you do both.

Here are some ways you can use this feature to help manage your cash flow and reduce your risk of bad debt and insolvency.

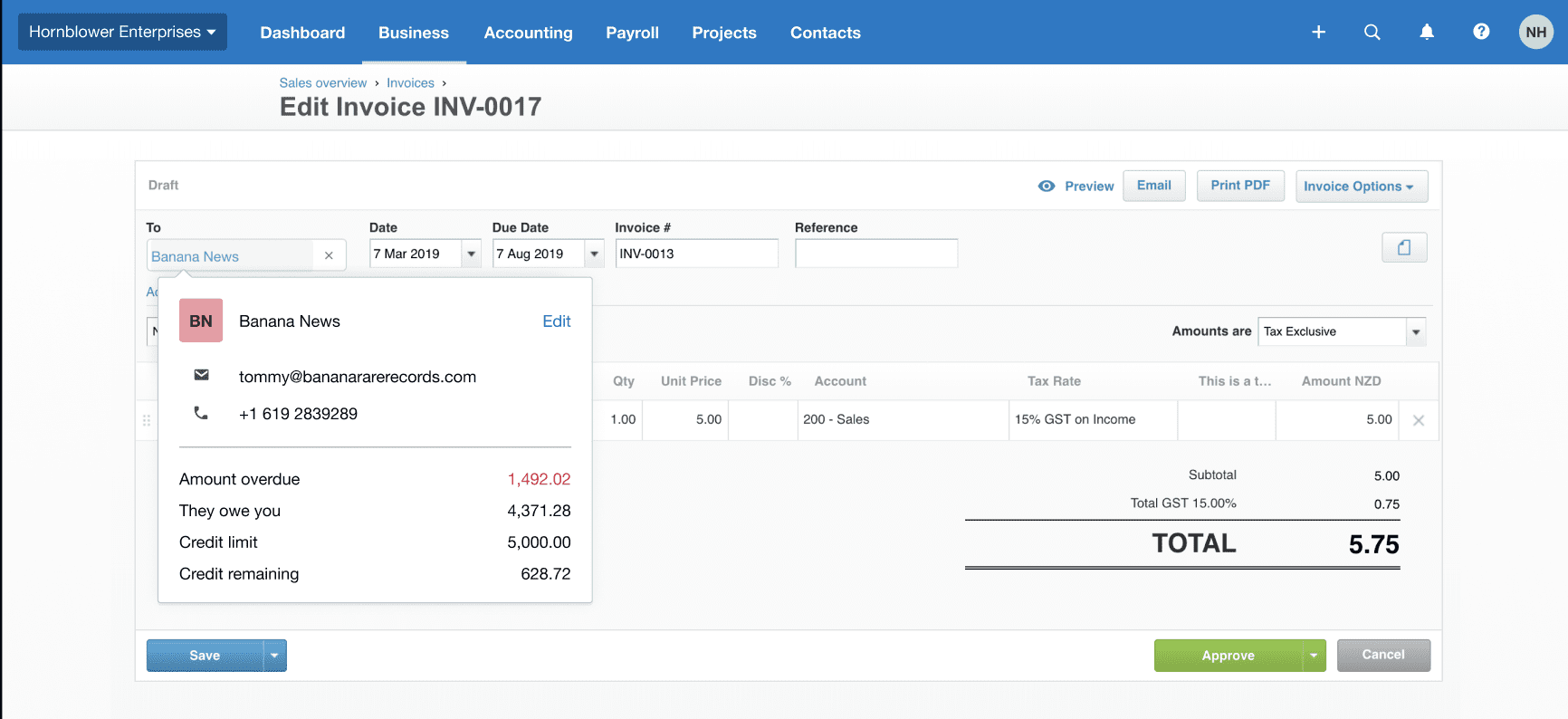

View outstanding balances

Before sending a new invoice, it’s a good idea to check whether the customer owes you any money. You can do this by hovering over the contact – our customer credit limits feature lets you see the amount the customer owes you and how much of that is overdue. You can then make a decision as to whether to continue with the sale.

Set customer credit limits

You may also like to consider setting a credit limit for regular customers. Credit limits encourage customers to pay their outstanding invoices faster, improving your cash flow and reducing the risk of bad debt. You can set credit limits for customers within contacts, then view them within that contact or when creating a new invoice.

If you’ve already set credit limits for your customers, go back and review them to make sure they’re appropriate in this current economic climate. It’s also a good idea to review your payment terms and tighten them up where you can (for example, reducing them from 30 days down to 7 or 14 days), particularly for new customers or those who consistently pay late.

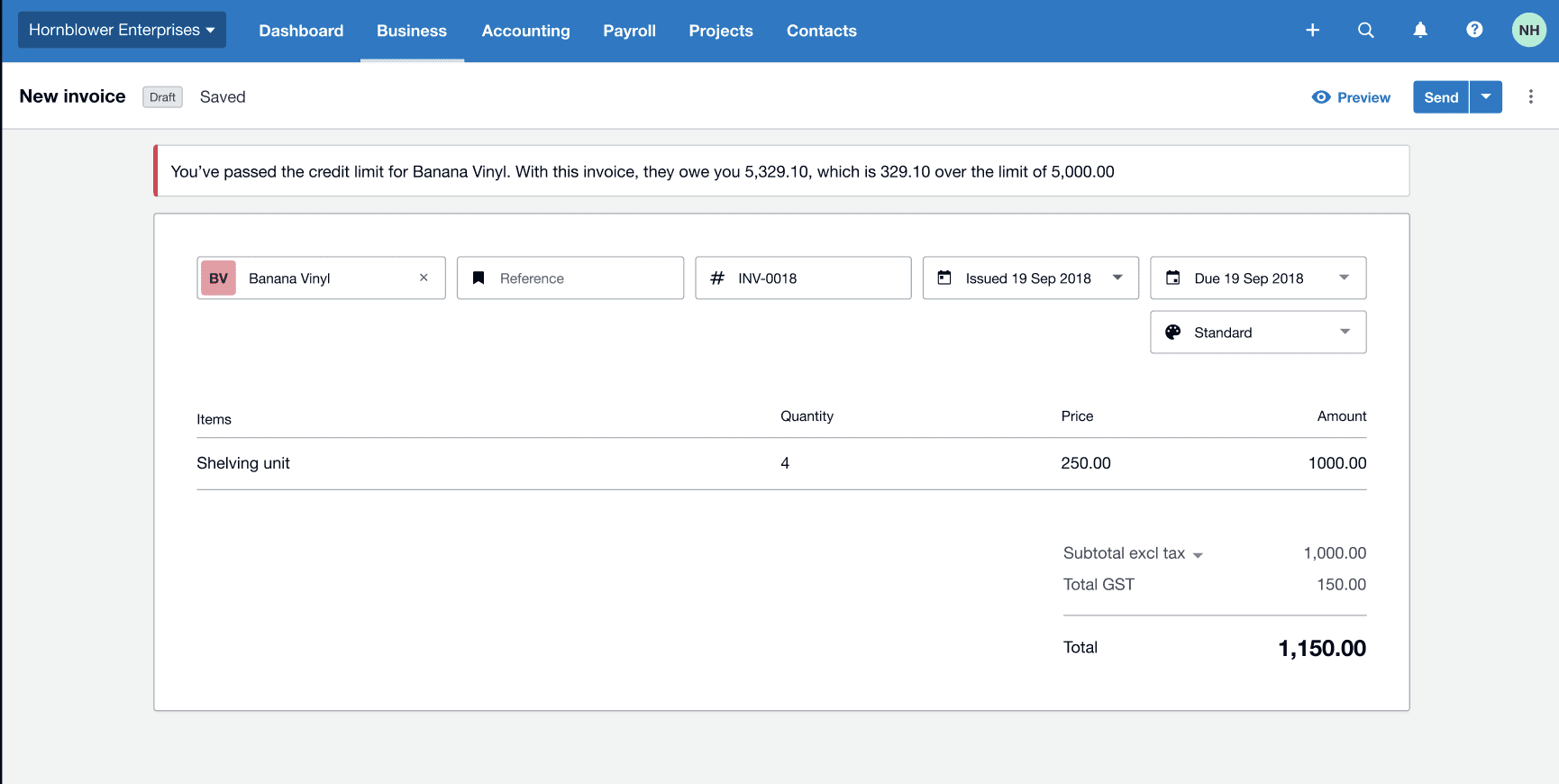

Make just-in-time decisions

Our team has now rolled out a new phase of customer credit limits, called credit alerts. When creating a new invoice for a contact with a credit limit, you’ll now see a banner displayed when that contact has reached their credit limit. As line items are removed and/or added, the banner will display the credit available in real time. Credit alerts will only be available in new invoicing.

This means you don’t need to worry about calculating whether the customer has reached their credit limit or not, Xero will do it for you. You can then decide whether to proceed with the invoice, adjust the invoice, or let the customer know they’ll need to settle their debt before you’ll extend any more credit to them.

Stop extending credit

When external bookkeepers or multiple staff are creating invoices on behalf of your business, it can be hard to control the amount of credit extended to customers. The final phase of customer credit limits automatically blocks someone from sending or approving an invoice, if it exceeds the credit limit for that contact (only available in new invoicing). If the invoice due to go out is a repeat invoice set to send automatically, the invoice block will prevent it from being sent and the invoice will go to drafts instead.

This is one of the most requested features from our community, so we are really pleased to bring this to you. We hope you find customer credit limits helpful when managing your cash flow – for more information on setting it up, visit Xero Central.

Share this article

[addtoany]