Introducing our latest enhancements to the Singapore GST F5 return experience

At Xero, we understand the importance of keeping the GST process simple and beautiful. Xero helps small businesses to stay IRAS compliant by allowing you to prepare your GST returns with automatic recording of GST and generation of GST F5 returns and IRAS Audit files.

With a Premium business plan, you can manage foreign currency transactions and accurately track, review and manage GST transactions within Xero.

Our latest updates to Xero’s suite of GST F5 features has made collaborating with your advisor easy, with reporting tools that allow you to view your next due date and amounts owed at any time. Transactions can also be sorted and grouped based on IRAS requirements, which simplifies reviewing and amending within each return. You also have the ability to export reports in Excel format, giving you flexibility across formats.

With tax season soon upon us, find out more about our latest enhancements to make your GST F5 return experience more intuitive and seamless.

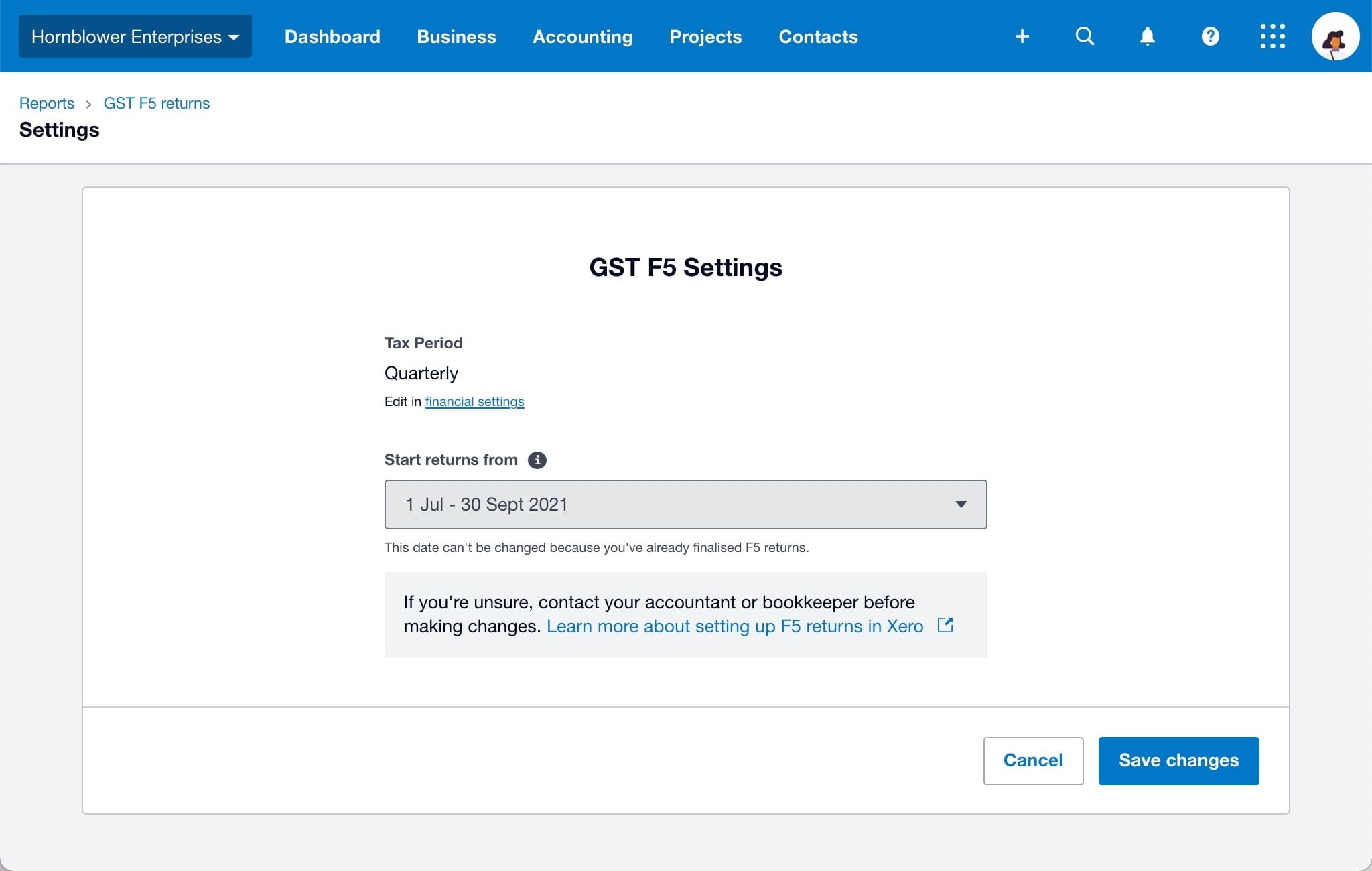

Setup made easy

We’ve updated the platform so you can access the settings function directly in the GST F5 module. The settings page now includes Singapore tax filing periods, to reduce the chance of incorrect setup.

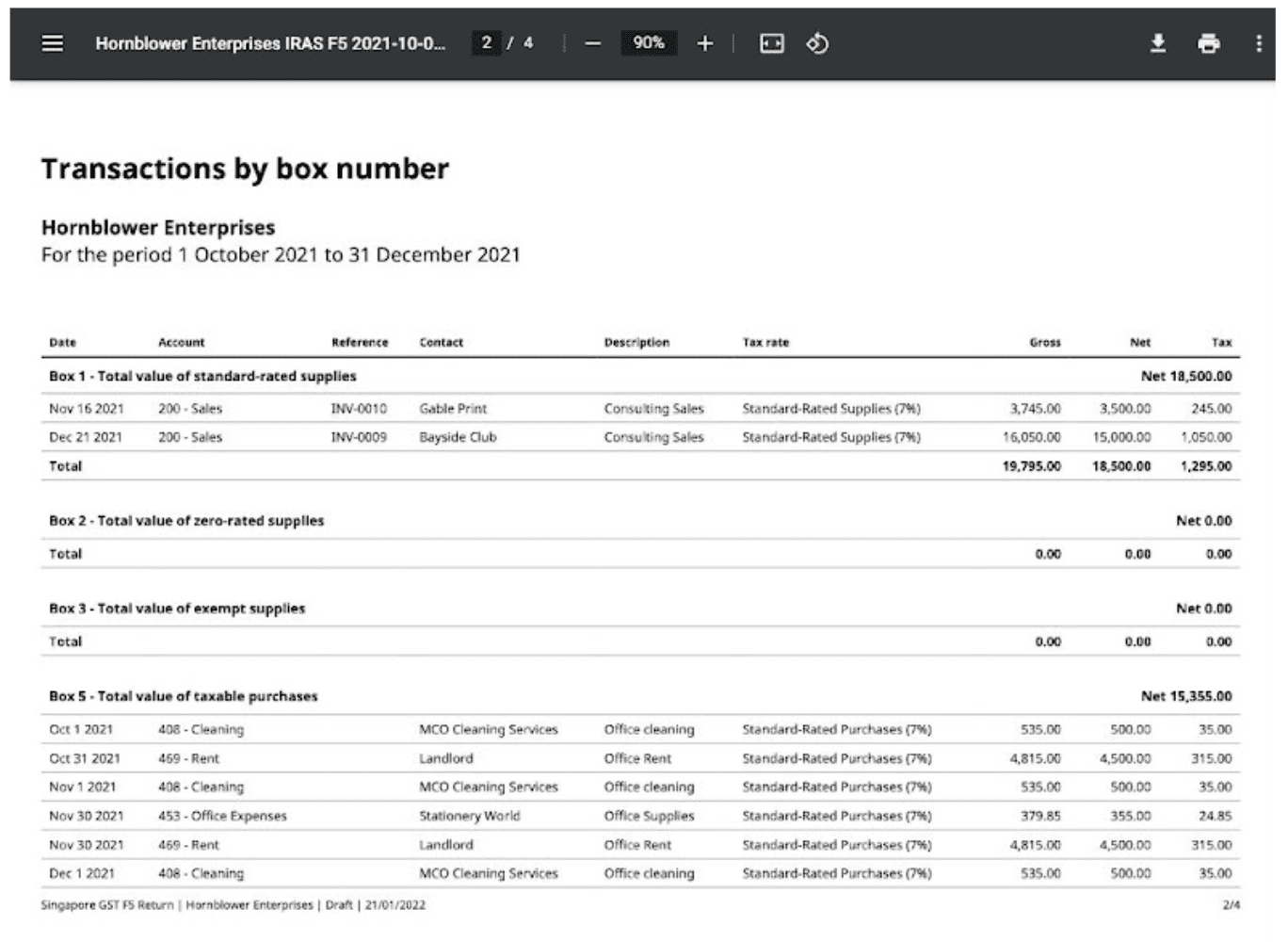

Share information with your advisor

We’ve also added an export to PDF function, which captures all amounts and data for the GST period at that point in time. The PDF can be sent to your advisor for quick sign-off, as well as kept as a record of what has been filed with IRAS.

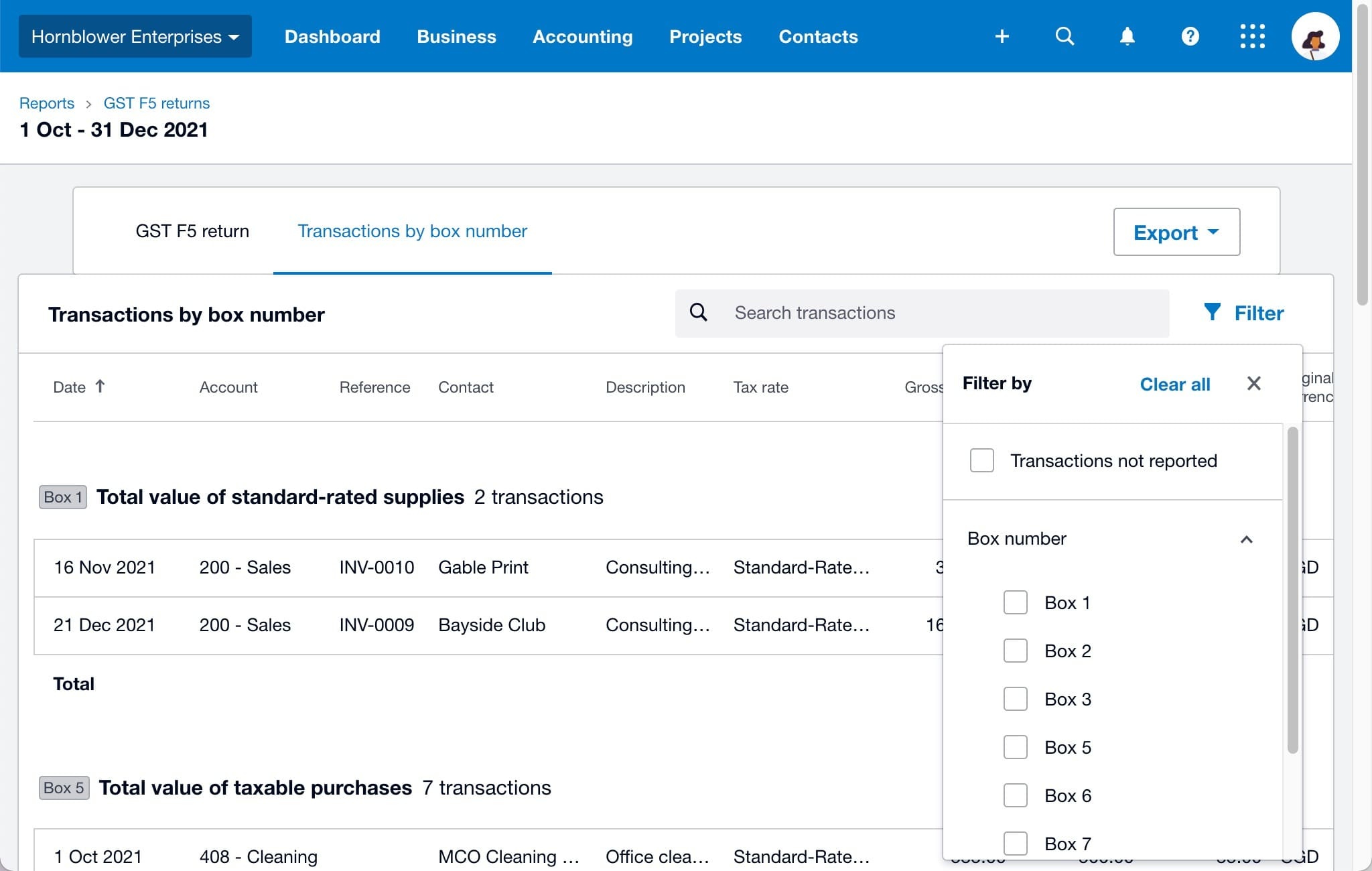

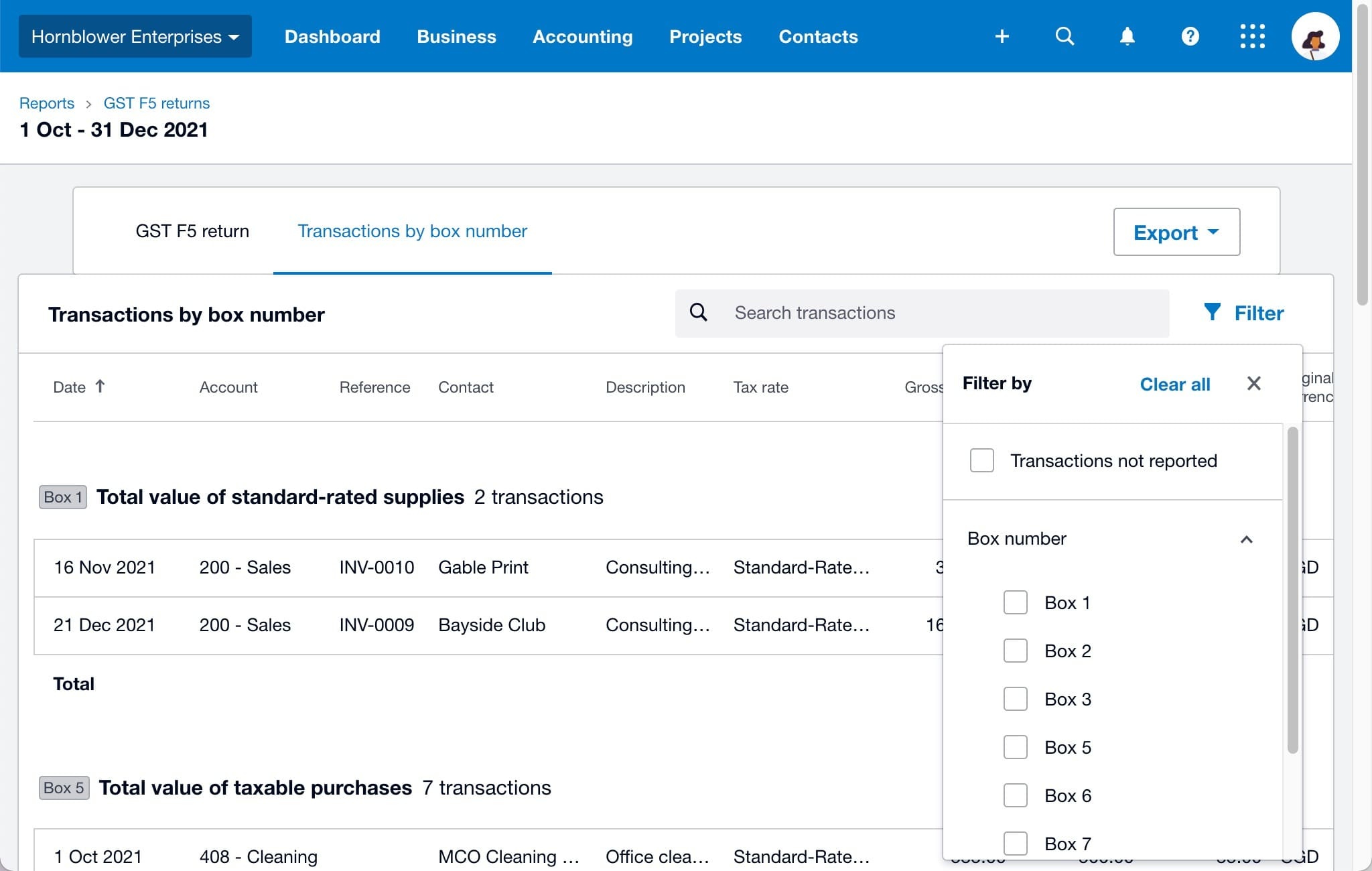

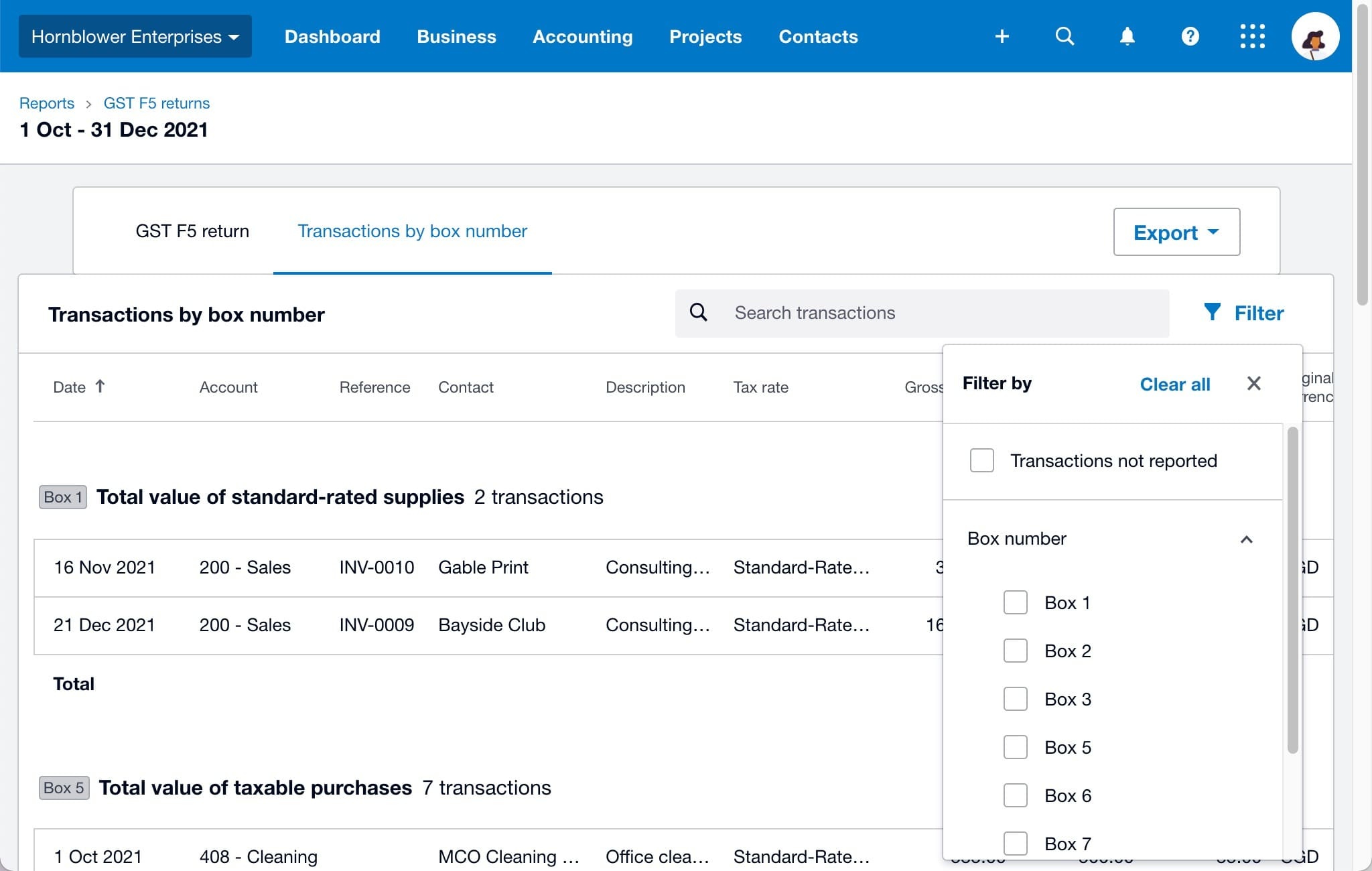

Customise your transaction reports

We’ve introduced enhanced filters, for a more efficient review of transaction reports. You can now display the specific boxes you want to review, rather than all transactions for your business at once. Excel ‘transaction by box number’ exports now include transaction details, with hyperlinks to Xero grouped by GST F5 box totals.

More GST enhancements on the way

We’re committed to enabling direct filing of GST returns from Xero to IRAS, so you can streamline your processes and build more efficiency in your business. Our teams are already working on direct filing of the GST F5 form, and building forms F7 and F8 with direct filing to IRAS.

In the meantime, check out Xero Central for more information on running a GST F5 return and how our GST F5 improvements work.

Share this article

[addtoany]