Managing the complexities of payroll during COVID-19

If you’re like many small business owners and advisors, you’re probably facing unprecedented changes to your payroll as a result of COVID-19. Whether you’re applying government subsidies and relief packages, calculating new sick pay and leave entitlements, or standing down large numbers of staff, staying up-to-date on the latest changes can be overwhelming.

Our payroll teams are working hard to simplify and automate a lot of the new payroll changes, so you can spend less time worrying about compliance and more time focused on your business.

We’re also working closely with government agencies to understand what changes are coming up and the impact they’ll have on your business. This not only ensures that our interpretation of the legislation is correct, but also gives us an opportunity to share our insights on the health of the small business sector.

In Australia

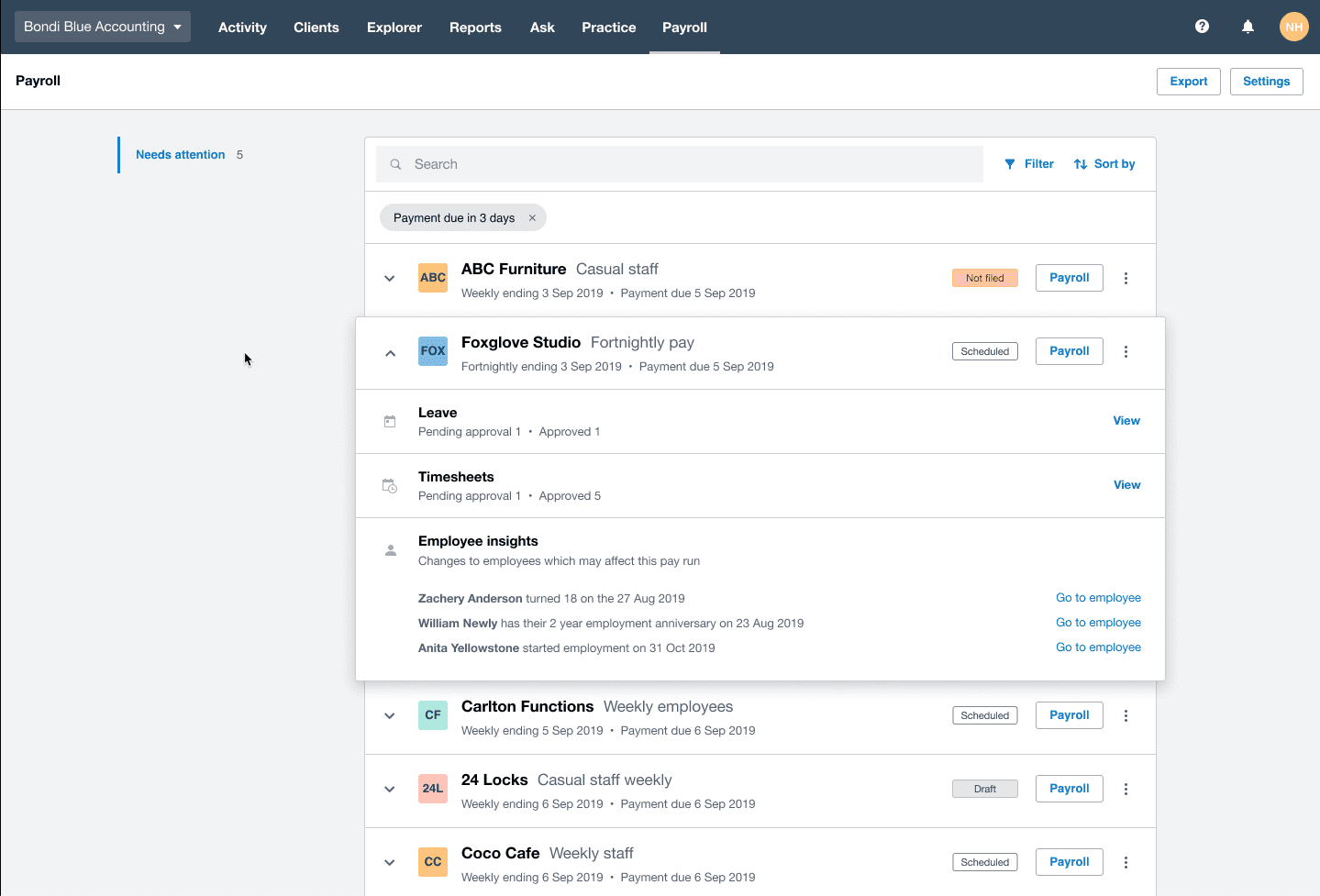

We’ve launched Xero HQ Payroll, which provides accountants and bookkeepers with one place to manage important payroll tasks – including visibility over which clients haven’t set up Single Touch Payroll (STP). The Australian Tax Office will use STP data to collect information on employees who are eligible for the JobKeeper payment and ensure they’re paid correctly. So having this visibility will be an important tool for advisors in the months ahead.

The Fair Work Commission has also proposed changes to Australian awards, including unpaid pandemic leave and the flexibility to take annual leave at half pay, doubling their time off work. We’re staying on top of these proposed changes and will be keeping you informed once we know more, even if it doesn’t change the way you use Xero. For example, the Australian Government has temporarily removed the need to provide separation certificates to employees when they’re stood down.

In the UK

We’ve added ‘COVID-19 self isolation‘ as a sick leave option for employees who are required to self-isolate, so they can earn sick pay from day one instead of the usual four consecutive days. HMRC are currently working on a process to help small and medium-sized businesses reclaim two weeks of self-isolation sick pay – once this is ready, we’ll help you capture these records and support the reclaim process.

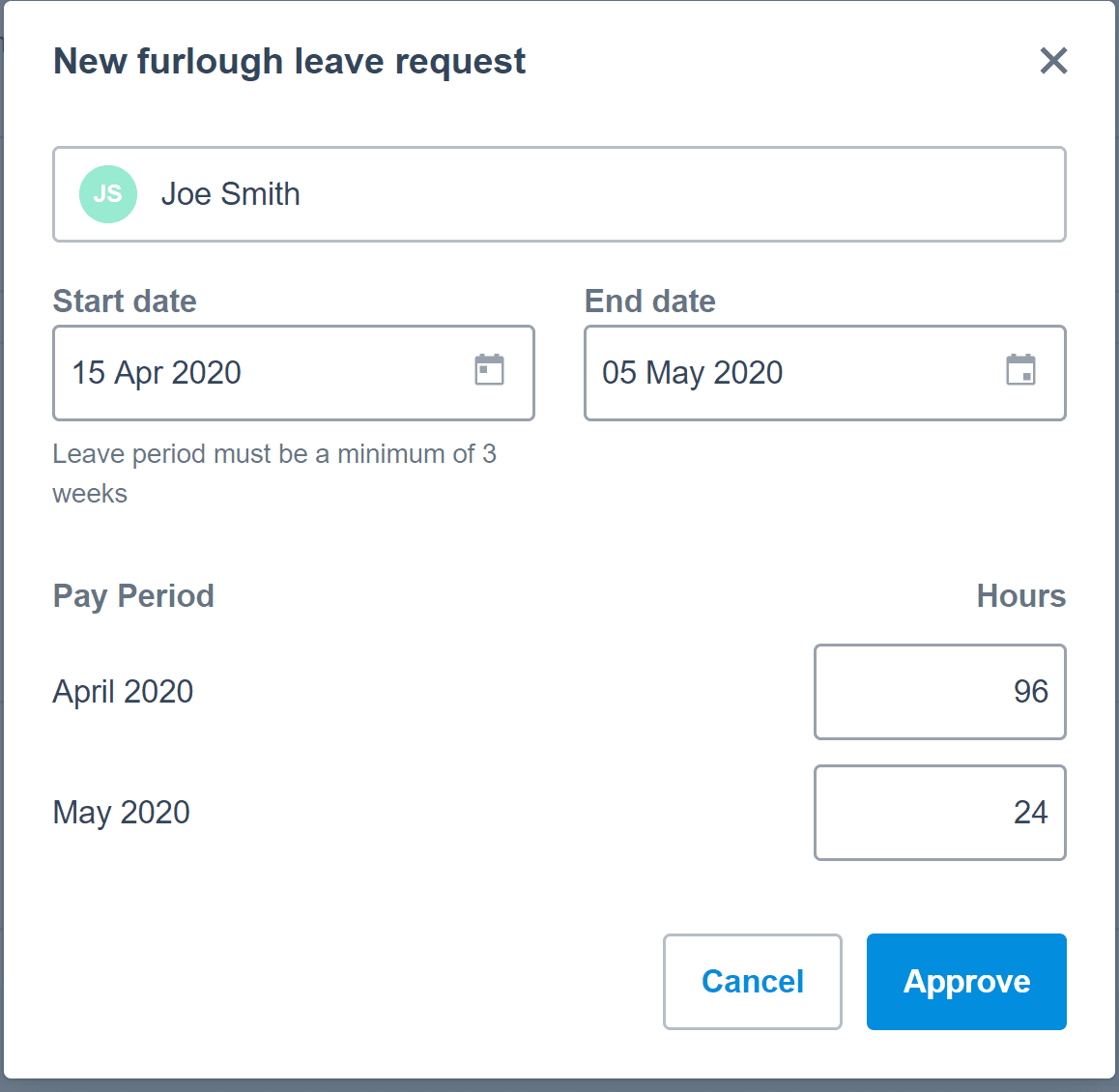

Our team has also released a solution to help you participate in the Job Retention Scheme (JRS), where HMRC will provide a grant to cover 80% of furlough employee pay, up to £2,500 per month. The Scheme also covers associated furlough costs for your national insurance and minimum pension contributions. Furlough employees won’t be able to work, but they’re free to do training, volunteer for frontline services or support those in need during COVID-19.

All Xero Payroll customers in the UK can now process furlough leave for eligible current or reinstated employees. The solution lets you easily split out the wage costs of furloughed workers in preparation for the grant claim, which is available currently for the period 1 March to 30 June 2020 and will be processed by HMRC via your PAYE online account. We hope it will help you support employees while they’re unable to work, and make it easier to reinstate them once the crisis has passed.

You can now view our webinar recording online to see a demo of how to record furlough leave in Xero Payroll or find our guidance on processing furlough leave in Xero Central.

In New Zealand

The Government is providing two payments to support employers affected by COVID-19. The Wage Subsidy is to support your business if you have to lay off staff or reduce their hours as a result of COVID-19. The other is the Essential Workers Leave Scheme, which is there to help you pay employees if they can’t come into work due to Ministry of Health guidelines, and can’t work from home.

If you have employees with variable work hours and need to work out if their Wage Subsidy should be applied at a full-time or a part-time rate, our updated pay history report in Xero Payroll can help. The report now shows the number of hours worked and rate of pay for each of your employees. Here’s more information on managing the Wage Subsidy and Essential Workers Leave Scheme in Xero.

In North America

We’re working closely with our payroll partner, Gusto, to help you access the Payroll Protection Program (PPP). The PPP authorises loans with Small Business Association lenders, to cover payroll and associated costs for your employees. If you’re a Xero customer using Gusto Payroll, you’ll get a notification in Xero that will direct you to the report in Gusto, which has all the payroll information you need to apply for the PPP loan.

While we’re completely focused on helping you get through this period of uncertainty, we’re also acutely aware that at some point, you’ll need to transition your business into the next phase of recovery and growth. What that looks like and when it will happen is anyone’s guess, but having accurate payroll records is going to be a critical part of maintaining compliance and supporting your employees through COVID-19 and beyond. As always, our teams around the world are here to help and committed to making payroll as easy as possible for you.

Share this article

[addtoany]