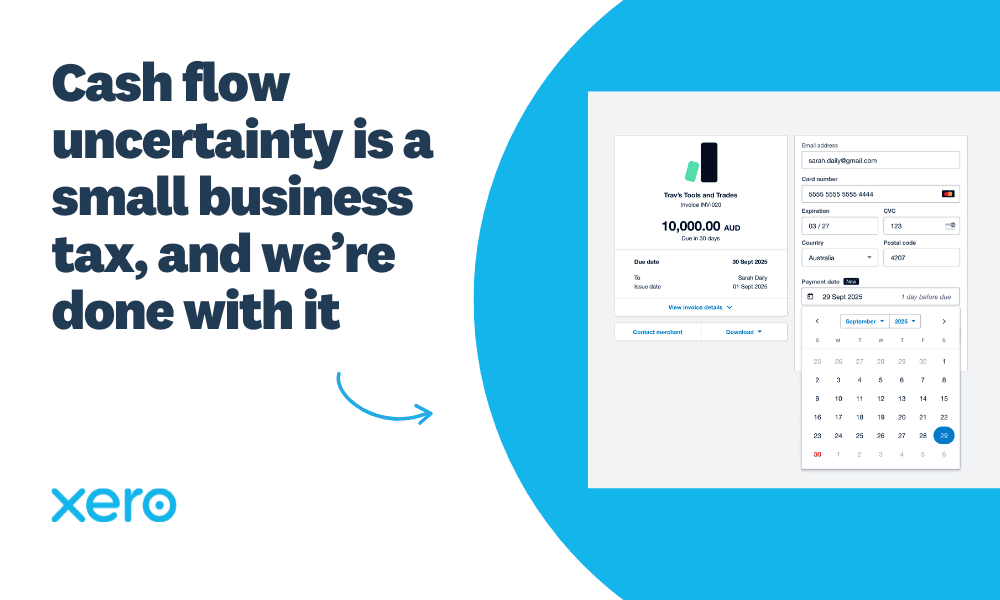

Cash flow uncertainty is a small business tax, and we’re done with it

How smarter invoicing, payment tools and automation are helping you take the guesswork out of getting paid.

For most small businesses, cash flow uncertainty isn’t an occasional headache, it’s a constant one. You do the work, you send the invoice, and then… you wait. Not knowing when money will land, whether a client will pay on time, or how to cover costs in the meantime is what keeps small business owners up at night.

This isn’t just an admin hurdle, it’s a global drain on small business health. The numbers paint a stark picture: nearly half of payments made to small businesses are late.

The friction points that make it worse

Getting paid starts with the invoice you send – and limited customization tools make it difficult to create professional invoices that truly represent your brand, often driving you to third-party tools.

We also know, no two businesses operate the same way. Whether you’re collecting deposits, accepting partial payments, or managing a mix of both, the tools available today meant many businesses had to resort to clunky workarounds that delayed cash flow when they needed it most. Which is why we’re committed to building out a suite of flexible tools that adapt to the way you work.

On the other side of the equation: when paying is complicated, customers put it off. Or forget altogether.

Our mission: break the cycle

At Xero, our ambition is to unify payments, insights, and automation to cut down admin and help you stay cash flow positive more often.

Many of you lived through the transition to the new version of invoicing last year — it was a significant shift and we know it felt painful at times. But by leaving legacy technology behind we’ve cleared the path for the innovation we’re delivering today.

That starts with JAX, our financial superagent — designed to help you work faster while keeping you firmly in the driver’s seat.

Work smarter with JAX

JAX is already transforming workflows:

- Batch creation: Simply describe what you need like: “Create invoices for this client portfolio,” and JAX handles the heavy lifting.

- Instant insights: Ask JAX to identify overdue accounts or pull specific payment histories in seconds.

Beyond JAX, we have been laser focused on making the core invoicing experience faster. We’ve heard your feedback loud and clear, and streamlining invoice creation remains our top priority.

Closing the gaps that delay your cash flow and making it even easier to pay

We’re closing the gaps that delay your cash flow by removing the friction that makes it hard for customers to pay.

Get branded invoices, automatically. Upload your logo with the new invoice template editor and Xero pulls your brand colors to create professional invoices that speak your brand. Tweak fonts, rename columns, add payment details, and more – simple editing tools put you in charge, no designer required.

Let customers clear statement balances in one go: We’ve added a ‘Pay’ button to online statements so customers can pay multiple invoices at once with a single payment. Xero customer Joseph Young saw the difference immediately: clients started paying “multiple monthly invoices early,” which “boosted cash flow.”

Looking ahead to what’s coming

The tools available right now are ready for you to try out and see the difference for yourself, along with existing features that already help you get paid faster – from reaching clients instantly via SMS invoicing so you get paid on average the same day, to removing payment barriers by offering more ways to get paid like cards, secure bank transfers, and Buy Now, Pay Later.

But we’re just getting started – we’re continuing to build on this foundation to give you even more flexibility across your payment tools in Xero to make your cash flow predictable.

- Accept deposits to start work with confidence: Soon, you’ll be able to accept payments before you start work to secure cash flow, cover upfront costs, and keep business moving.

- Stay in control with strategically timed invoices: Scheduled invoicing will put you in control, allowing you to time your invoices to hit the inbox when your customers are ready to pay.

- Turn customer promises into predictable cash flow: Soon, you can let customers commit to a future payment date from the moment they receive the invoice – helping them avoid missed due dates. They get flexibility, you get predictable cash flow that helps you plan ahead.

We know that for small businesses, every day counts when it comes to cash flow. These updates – from JAX automation tools to more flexible invoicing and payment options – are all part of our mission to make late payments a thing of the past and give you complete cash flow control.

Dive into the new invoice template editor today or try out JAX and see how much time you can win back.